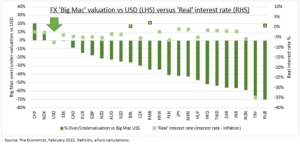

BURGERNOMICS: The Big Mac index is a useful short-hand for FX valuation, with a decent medium-term record. Updated numbers (see chart) show the USD strength, after its 2021 rally. We see limited room for more, especially after the surge in Fed rate hike expectations. A stable/weaker USD is positive for emerging markets, commodities, and US tech. Only Switzerland (CHF) and Norway (NOK) are more expensive than the USD. Big Macs are also a measure of inflation pressures. Local prices are up a surprising small 3% in US the past year, but 9% in UK and China, 67% in Turkey, and 350% in Lebanon.

REAL SUPPORT: Real interest rates (interest rates – inflation) are an important FX anchor. Only 3 of the 25 countries have positive real rates today. Brazil (BRL) has been hiking rates aggressively in face of double-digit inflation, whilst China (RMB) is cutting rates with inflation only 1.5%. Russia (RUB) is the most intriguing, with its dramatic Big Mac undervaluation and aggressive hiking cycle. The opposite extreme is Turkey (TRY).

THE INDEX: The index was created by The Economist in 1986 as a light-hearted way to compare whether currencies were over or under-valued. The theory (PPP – Purchasing Power Parity) is that long run exchange rates should equalize, so that similar goods have similar prices. It has spawned many spin-offs for similar globally available and standard products, like a tall latte (Starbucks), Billy bookshelf (IKEA), and iPhone (Apple).

All data, figures & charts are valid as of 15/02/2022