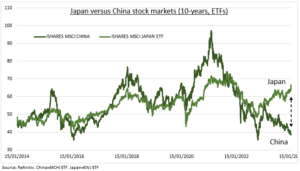

DIVERGENCE: We’ve seen a big breakdown in the historically strong correlation between the world’s 2nd and 3rd largest stock markets. Japan (EWJ) has kept rallying and been the best major performer this year. As the ‘worlds forgotten market’ finally puts three decades of deflation and stagnation behind it. Whilst China (MCHI) stocks had the worst start of any. As navigate a tough three-pronged consumer, property, and export challenge. It’s been a value trap with no policy visibility but has multiple contrarian drivers for the brave and should not be ignored. Whilst there is likely more to go for the rerating Japanese Yen and rotation to long-suffering domestic stocks.

JAPAN: The world’s no.3 economy and stock market has continued its strong 2023 momentum. The benchmark Nikkei 225 just crossed 36,000 for the first time in whopping 34 years. Deflation has reversed alongside the stronger economy and opened the door to monetary tightening baby steps. This has bolstered the Yen that is by far the world’s cheapest major currency. And seen a rotation toward cheap domestic focused stocks and banks. Whilst the authorities push reforms, from tax-exempt retirement savings accounts (NISA) to corporate governance changes and extended trading hours. Yet it still remains out-of-mind for most investors, per our latest survey.

CHINA: Its struggles have continued with stagnant 5% GDP growth and deflation, and an only tepid policy response. It faces three-headed headwinds of 1) consumer buyer strike, 2) property sector overhangs, and 3) weak global manufacturing demand. The central bank has again avoided cutting interest rates, despite deflation and some of the world’s highest real rates. It remains an intriguing but high-risk combo of cheap valuation, poor sentiment, stabilising economy, and policy flexibility. And cannot be ignored, with global impacts from commodities to Apple (AAPL). Fingers are crossed for the February 10th start of the auspicious Year of the Dragon.

All data, figures & charts are valid as of 16/01/2024.