Value investing is a powerful investment strategy first developed by Benjamin Graham and David Dodd in the 1930s. With this strategy, investors aim to buy stocks that they believe are trading below their true or “intrinsic” value. The idea is that eventually, the market — which can both overvalue and undervalue securities at times — will recognise the true value of the stocks, pushing their share price up.

The value approach to investing has been out of favour for much of the last decade, as growth investing has delivered superior returns. However, recently, value has made a big comeback.

Here, we’ll take a look at why value is delivering the best returns at the moment. We’ll also discuss how investors can gain exposure to this area of the market with eToro’s new ValueGurus Smart Portfolio, which is based on the 13F filings (quarterly reports that large investment managers are required to file with the US Securities and Exchange Commission to disclose their US stock holdings) of some of the world’s leading value investors.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Why value stocks are in focus

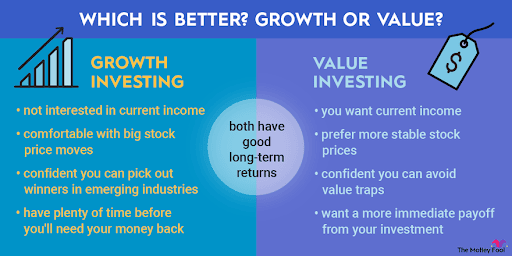

In an environment of high inflation and rising interest rates — like we are experiencing right now — value stocks tend to outperform growth stocks. This is largely due to the nature of value stocks’ cash flows.

To evaluate companies, analysts typically use discounted cash flow models, which discount businesses’ future cash flow back to a present value using a certain interest rate (which is linked to interest rates in the economy). By adding together the present value of a stock’s future cash flow, analysts can obtain an estimate of its true value.

Now, when interest rates rise, and equity analysts tweak their financial models to reflect the higher rates, the estimated valuations of value stocks tend to hold up far better than the estimated valuations of growth stocks.

The reason for this is that the cash flow of value stocks is generally near-term weighted. Value stocks tend to be found in sectors such as financial services, industrials, and materials. And companies that operate in these sectors are typically generating cash flow now.

In contrast, growth stocks, which are typically found in sectors such as technology and biotech, tend to have cash flows that are weighted to the long term. Often, companies in these sectors are not expected to generate a meaningful level of cash for years.

All else being equal, the further out a company’s cash flow is, the more its valuation will be impacted negatively by an increase in interest rates due to the way future cash flows are discounted back to present values. So, ultimately, in today’s environment, near-term cash flow is far more valuable than future cash flow. This explains why value is outperforming growth today.

It’s a similar notion with inflation. During periods of high inflation, the real value of a dollar generated today is higher than the real value of a dollar generated in the future. So, in the current environment, value stocks have more appeal to investors than growth stocks due to the fact that they are generating a higher proportion of their cash flow now.

Other benefits of value stocks

There are a few other features of value stocks that are increasing their appeal today.

Dividends — another form of cash flow — are one such feature. Value stocks tend to pay dividends to their investors because the underlying companies are well established and profitable. In the current market environment, where capital gains are hard to come by, dividends are extremely valuable and can help boost investor returns.

Lower volatility is another feature of value stocks that is attracting investors right now. Compared to growth stocks — which are susceptible to big falls when market volatility is high — value stocks tend to be quite resilient. As a result, they can offer investors downside protection during bear markets or periods of market turbulence. Given the high level of economic uncertainty that we are facing today, many investors are turning to value stocks for portfolio protection.

A long history of strong returns

It is worth pointing out that value investing does not just perform well in an inflationary / rising-interest-rate environment. Over the long term, the approach has delivered excellent returns, outperforming growth on a regular basis. According to research by investment firm Dimensional, US value stocks outperformed growth stocks by 4.1% per year between 1927 and 2021. And since 1940, value has outperformed growth over 10-year periods every decade except for during the 2010s.

Given this strong long-term performance, it is worth considering some exposure to value stocks. Particularly in the current environment, where inflation is rampant and interest rates are rising.

Follow the value investing stars

Over the years, value investing has created some of the biggest names in the investment world including the likes of Warren Buffett, Charlie Munger, David Tepper, and Bill Ackman.

In light of this, eToro has created an exclusive ValueGurus Smart Portfolio, which is based on the top holdings of some of the world’s most successful value investors. This Smart Portfolio comprises 10 stocks held by well-known value investment managers that have delivered superior returns for investors over the long run such as:

- Appaloosa Management — the hedge fund founded and run by billionaire value investor David Tepper

- Starboard Value — a New York-based investment firm that seeks to invest in deeply undervalued companies

- ValueAct Capital — a San Francisco-based investment company that manages money on behalf of some of the world’s largest institutional investors

Stocks in the ValueGurus Smart Portfolio at present include Google owner Alphabet, private equity powerhouse KKR, electronic broker Interactive Brokers, and data storage specialist Seagate Technology. Going forward, the portfolio will be updated quarterly based on the latest 13F filings of each investment manager selected. However, 13F filings do not have to be published until 45 days after the end of each quarter, so 13F changes will be reflected in the Smart Portfolio the following quarter.

Designed for long-term investors, this Smart Portfolio is suited to those looking for a professionally managed value portfolio that benefits from the expertise of some of the world’s leading value investors.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.