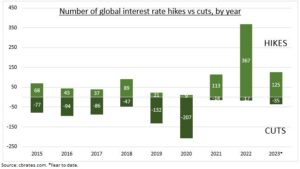

CYCLE: The global interest rate cycle is turning down as inflation falls. Chile slashed interest rates by 1.0% last week. Brazil followed with 0.5% this week. They are the first major central banks to start cutting rates this cycle. This saw Investors endure an unprecedented 350 net rate hikes globally last year (see chart). Stocks typically rally into the first cut, then they see some profit taking. Before later recovering as both valuations and earnings benefit from the stronger growth and lower interest rate outlook. But sector leadership often changes, with interest rate sensitives like real estate doing better, and traditional defensives, like staples lagging.

LEAD: Falling inflation and early, big interest rate hikes are putting LatAm and eastern Europe in the vanguard of the turning global interest rate cycle. Chile and Brazil have just started cutting, with Peru, Colombia and Mexico expected to follow this year. Hungary is set to lead eastern Europe with Poland and Czech following. Whilst Canada will likely be the first big developed market to cut early next year, with consensus expecting the US Fed to follow as early as March. At the back of the interest rate line are the UK and New Zealand, with more hikes to come. Whilst the world’s no.3 economy, Japan, is only just taking its first tightening baby steps.

PERFORMANCE: LatAm and eastern Europe are some of the best performing markets this year in anticipation of coming interest rate cuts. Their undervalued currencies also performed well as the better growth outlook has offset much of prospect of lower interest rate differentials. Similarly, US stocks historically gained an average 7% between the interest rate peak and first cut, looking back to the 1980’s. Performance is typically weak after the first cut, which markets have anticipated, but strengthens later as lower rates support both valuations and earnings.

All data, figures & charts are valid as of 03/08/2023.