As an investor, it’s natural to feel uncertain when the stock market experiences a downturn. While it is difficult to predict how long the market will stay low, it is important to keep in mind that bear markets are just a normal part of the market cycle and as history shows us, things could likely get better — eventually.

Every dramatic decline, such as a bear market which sees a prolonged decline of 20% or more in the past, has eventually been followed by a bull market, which is a period of rising stock prices. For example, since 2000, the S&P 500 index, which tracks the performance of 500 large publicly traded companies, has seen an increase of 145%, including four bear markets during this timeframe.

It is important to keep in mind that past performance does not guarantee future results and that the market may experience further drops even after a bear market. However, for long-term investors with a diversified portfolio, bear markets can be an opportunity to rebalance your portfolio to make the return potential stronger.

With that in mind, we will be sharing with you a series of emails in the hope that they will help you get ready for 2023.

Did you know:

- A bear market is a period of declining stock prices, typically lasting for between a few months to a few years. After a bear market, it is common for the stock market to experience a period of recovery, as investors become more optimistic about the future prospects of the economy and corporate profits.

- Not all bear markets end the year with a negative return. In 2020, the market witnessed a bear market during the year, however, the market ended the year with a net gain of 18.4%. So, even if we continue to see a decline into 2023, this does not necessarily mean it will end down.

If you look on average, the S&P 500 has returned about 11% per year since it was first established in 1957 even though during those 66 years, the market went through several crises.

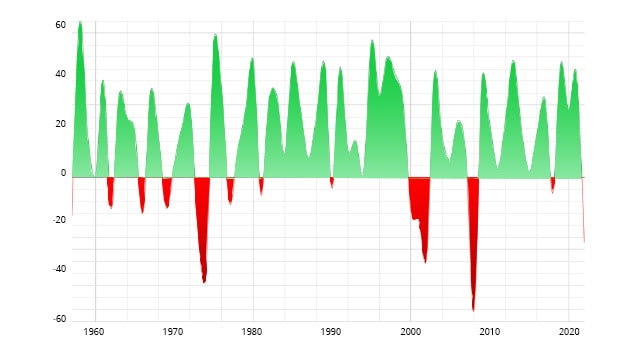

As you can see in the image below, historical data shows that on average, the stock market goes up in the year following a negative year, with the exception of two periods since the S&P 500 was launched. In 1973, the market fell two years in a row and, in 2000, it declined 3 years in a row. As such, the odds for the market to have a year-over-year decline are 3%, which are extremely low odds and could potentially be taken as a sign for what is to come.

Past performance is not an indication of future results.

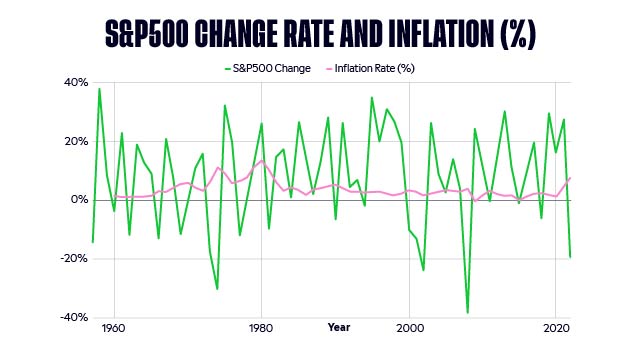

You might be concerned that due to rising inflation, this time could be different. History also shows that this assumption is not true. The table below shows the market return vs inflation and one can see that even with the highest inflationary period of 1973, the market outperformed over the long term.

Past performance is not an indication of future results.

With that in mind, this could suggest that with 2022 marking a 19.5% decline due to high inflation and a rise in interest rates, this could be a good opportunity to revisit your portfolio and rebalance it for the future. But, before that, here are some strategies to consider when it comes to weathering a bear market:

- Don’t panic: It is important to try to stay calm and not make any rash decisions during a market downturn. It is natural to feel anxious, but try to remember that bear markets are a normal part of the market cycle and that the stock market has always recovered from previous downturns.

- Make wise choices: During a bear market, many stocks perform badly, however, those with strong business fundamentals are more likely to remain resilient. Selecting these stocks to be a part of your portfolio can help you to get through a downturn without suffering major losses.

- Stay informed: It is important to stay informed about market developments and the economic conditions that may be impacting the market. By staying up to date, you can make better-informed decisions about your investments and be better prepared to weather market downturns. For instance, you can engage with other like- minded investors using your eToro feed.

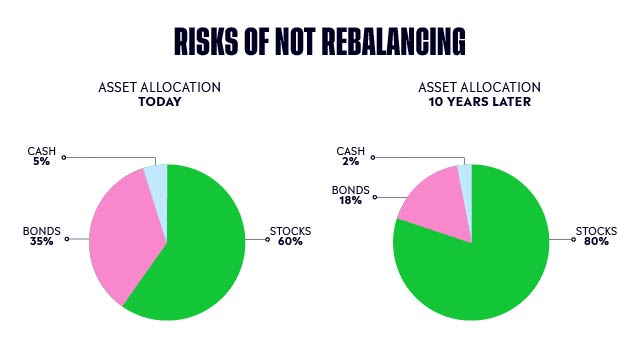

Rebalancing your portfolio involves selling off some of your assets that have grown in value and using the proceeds to buy more of your undervalued assets. This helps to maintain a balanced portfolio and can potentially generate returns during a market downturn. Diversify across regions, sectors and asset types.

The pie charts below are an example, but not a recommendation for a portfolio structure, and illustrate the importance of rebalancing your portfolio over the years to ensure that one particular asset type does not engulf the others and put your portfolio at a higher risk.

Bottom Line:

While it is natural to feel uncertain about market downturns, it is important to take a long-term perspective and not make any rash decisions based on short-term market movements. It is also important to diversify your investment portfolio and not “put all your eggs in one basket,” as this can help to mitigate the impact of market downturns. While we don’t know exactly when the market will recover, history has shown that it eventually does.

In the next series of emails, we will share with you opportunities across a variety of assets that you may find suitable to use while rebalancing your portfolio.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.