QT: The US Federal Reserve is setting up to start easing the pace of its so-called quantitative tightening (QT) policy that is shrinking its gargantuan $7 trillion balance sheet. This is the logical second-step of the monetary policy pivot flagged in December. 1) A slowdown in Treasury and Mortgage bonds rolling off its balance sheet is consistent with an nearing of interest rate cuts. 2) Would support those bond markets. 3) Would calm investor fears of a repeat of the disorderly end to Fed’s first QT programme when it drained too much liquidity from the financial system. 4) And would open the door to others, from the ECB to BoE, to follow as their rate cuts also loom.

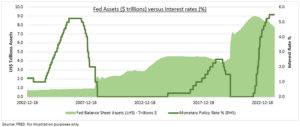

BALANCE SHEET: The Federal Reserve has been shrinking its balance sheet since April 2022 when it peaked at near $9 trillion (see chart). As it works to unwind the trillions it used to support the financial system in the covid pandemic. We are currently seeing US Treasuries roll off its balance sheet at a pace of $60 billion a month, alongside up to $35 billion of mortgage-backed securities (MBS). This has reduced its total assets by $1.3 trillion so far. This is already twice the balance sheet reduction of the Fed’s first QT programme that prematurely ended in 2019.

RISKS: Three concerns are pushing the Fed towards easing back on its quantitative tightening programme. 1) A desire not to send contradictory policy signals. By loosening monetary policy, through interest rate cuts, at same time as tightening, through QT. 2) Not to drain too much liquidity from the financial system. This is a by-product of QT, and by some measures is already nearing the buffers. with plunging excess liquidity, represented by reverse repo (RRP) levels. 3) Memories of 2019 instability. When the Fed over tightened – in hindsight – with its first QT programme, leading to a spike in funding rates and the early abandonment of the programme.

All data, figures & charts are valid as of 17/01/2024.