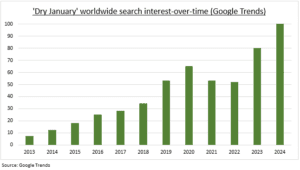

ALCOHOL: A ‘Dry January’ has become more popular (see chart). Driven by younger drinkers, secular health and wellness trends, and cyclical cost-of-living pressures. But this is more of an opportunity than a threat for the struggling brewer and spirits stocks. With little impact on their volumes so far, but the potential to grow significant no/low-alcohol brands. And to capture higher profit margins over time. With similar pricing but no-alcohol drinks paying no tax duty. In UK this is £21/alcohol litre for beer and up to £31.6 for spirits. The bigger sector threats are down-trading consumers, limits to management premiumisation strategies, and weight-loss drug adoption.

CONTEXT: Beer and spirits stocks have had a tough time recently. As consumers push back against their relentless price premiumisation strategies, and trade down to cheaper drinks. And investors worry about the impact of the GLP-1 weight-loss drug boom. Dry January is not yet another concern. With volumes seeing only a typical post-festive season drop. Making it more a ‘Damp January’. Whilst companies have ambitions to grow their no/low alcohol businesses. Anheuser Busch (BUD) has made its Corona Cero the official beer of the Paris Olympics and is targeting low/no volumes at 20% of its total sales over time. But these are much smaller today. Heineken (HEIA.NV) estimates its only 2% of the global market. Whilst Diageo (DGE.L) added a no/low alcohol portfolio to its traditional ten lineup but it’s too small to be broken out in its results.

HISTORY: It’s been ten years since charity Alcohol Change UK trademark registered the ‘Dry January’ term, encouraging people to sign up to abstain from alcohol for the month. Though its origins may stretch from Finland’s 1942 ‘Sober January’ to support its war effort. Its popularity is growing globally, as proxied by Google Trends data. With Gen Z leading the way and younger generations spending significantly less on alcohol than older. Whilst alcohol spending makes up 3% of total household expenses, split 2/3 at home and 1/3 on going out, based on UK figures.

All data, figures & charts are valid as of 01/02/2024.