Over most of the last 15 years, it has been hard to generate attractive investment returns from fixed-income securities or “bonds” as they are often called. Over this period, bond yields have generally been extremely low. Recently, however, yields have skyrocketed — meaning that it’s now possible to obtain very healthy returns from this asset class. With that in mind, here’s a look at eToro’s new fixed-income Smart Portfolio, YieldGrowth.

INVEST IN YieldGrowth

76% of retail CFD accounts lose money

What are bonds?

Since yields were low for so long, there is a whole generation of investors today who are unfamiliar with bonds. So, let’s start by looking at what they actually are and how they work.

Less risky than stocks, bonds are investments that represent loans made by investors to borrowers. Issued by governments, corporations, and other entities to raise money, they typically pay a fixed rate of interest to investors for a certain period of time.

You can think of bonds as fixed-term loans. When you buy one, you are essentially lending an entity money. In return, the entity promises to pay back the loan on a specified date along with a certain amount of interest.

Bonds are not complex investments. However, there are a few key terms to understand with this asset class such as:

- Issuer — This is the entity that is borrowing the money. For example, it could be a company issuing £100 million worth of bonds to raise capital for a new project.

- Coupon rate — When a bond is issued, the issuer commits to paying a certain interest rate on it. This is known as the coupon rate. Interest or “coupons” are generally paid annually or semi-annually.

- Price — Bonds have prices, and these prices are inversely related to interest rates. This means that when interest rates rise, bond prices tend to fall, and vice versa.

- Yield — Yield is the return an investor expects to achieve from a bond. It is estimated by dividing the annual coupon paid by the price. The precise yield takes into consideration the coupon payment dates and the maturity of the bond.

- Maturity — This is the maturity date of the bond. At this date, the loan is repaid to the investor along with any interest that is due.

- Duration — This is a measure of a bond’s sensitivity to changes in yields. It is essentially a gauge of interest-rate risk.

There are also a few different types of bonds to be aware of, including:

- Government bonds — These are issued by governments. US government bonds are considered to be one of the safest fixed-income investments.

- Investment-grade corporate bonds — These are securities issued by corporations with good credit ratings. They are considered to be safer fixed-income investments.

- High-yield corporate bonds — These are issued by companies with lower credit ratings. They can offer attractive yields, but are risky since there is often a high chance of a default.

It’s worth noting that the bond market is significantly bigger than the equity market. According to Morningstar, global bond markets are valued at around $300 trillion today, versus approximately $124 trillion for the global stock market1.

How bonds can play a role in a portfolio

Bonds can play a valuable role in an investment portfolio. Usually, they offer higher interest rates than savings accounts. This means that they can provide investors with attractive levels of income.

Meanwhile, they tend to have a low correlation to equities. This means that they can offer protection when the stock market is falling. If stocks fall, bonds can act as a buffer, cushioning any equity-related losses and providing portfolio stability.

Given these attributes, they can be very useful from a portfolio diversification perspective. By owning bonds alongside stocks, investors can potentially reduce their overall risk levels and smooth out their returns.

Just look at the performance of so-called “60/40” portfolios, which contain 60% stocks and 40% bonds. These portfolios — which many experts often recommend for investors seeking lower-risk balanced portfolios — typically deliver very consistent returns as bonds usually provide some protection when stocks are falling. If equities have a bad year and bonds have a good year, the gains from the bond part of the portfolio can be used to buy more stocks while share prices are lower and rebalance the portfolio.

Why fixed income is suddenly attractive again

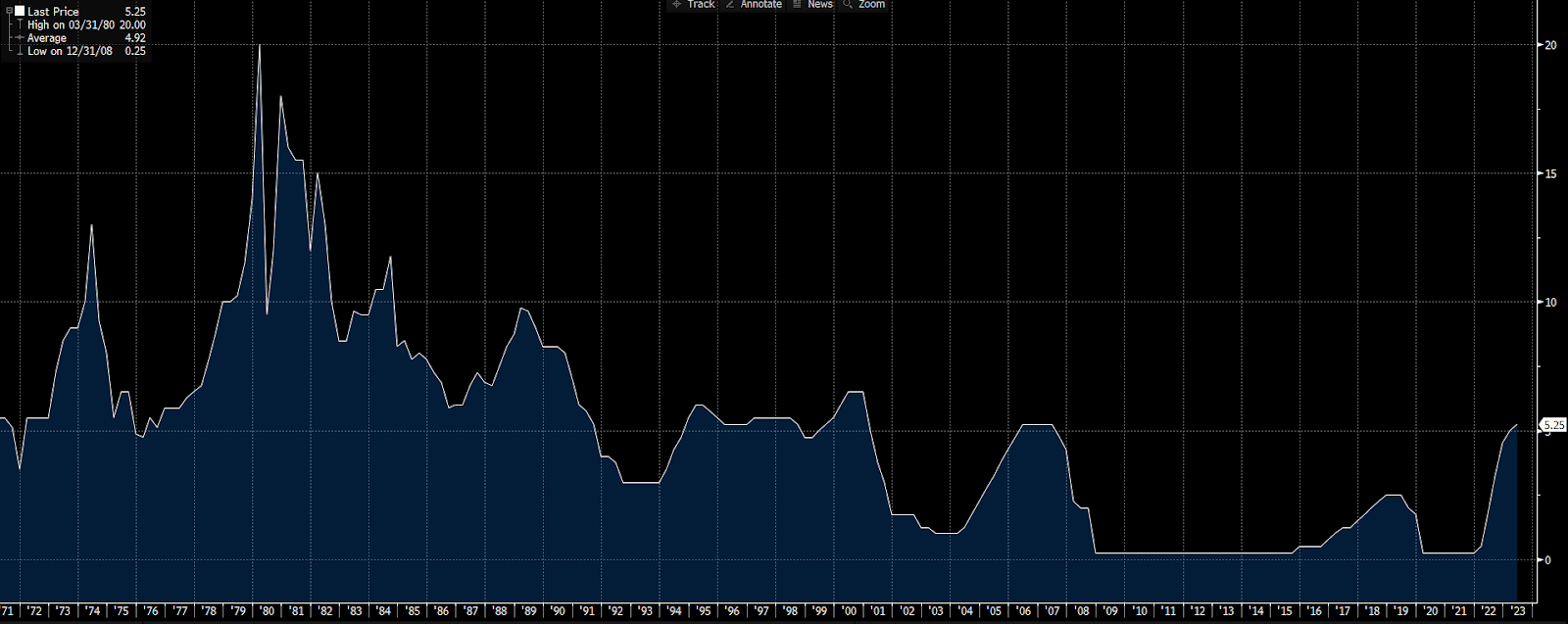

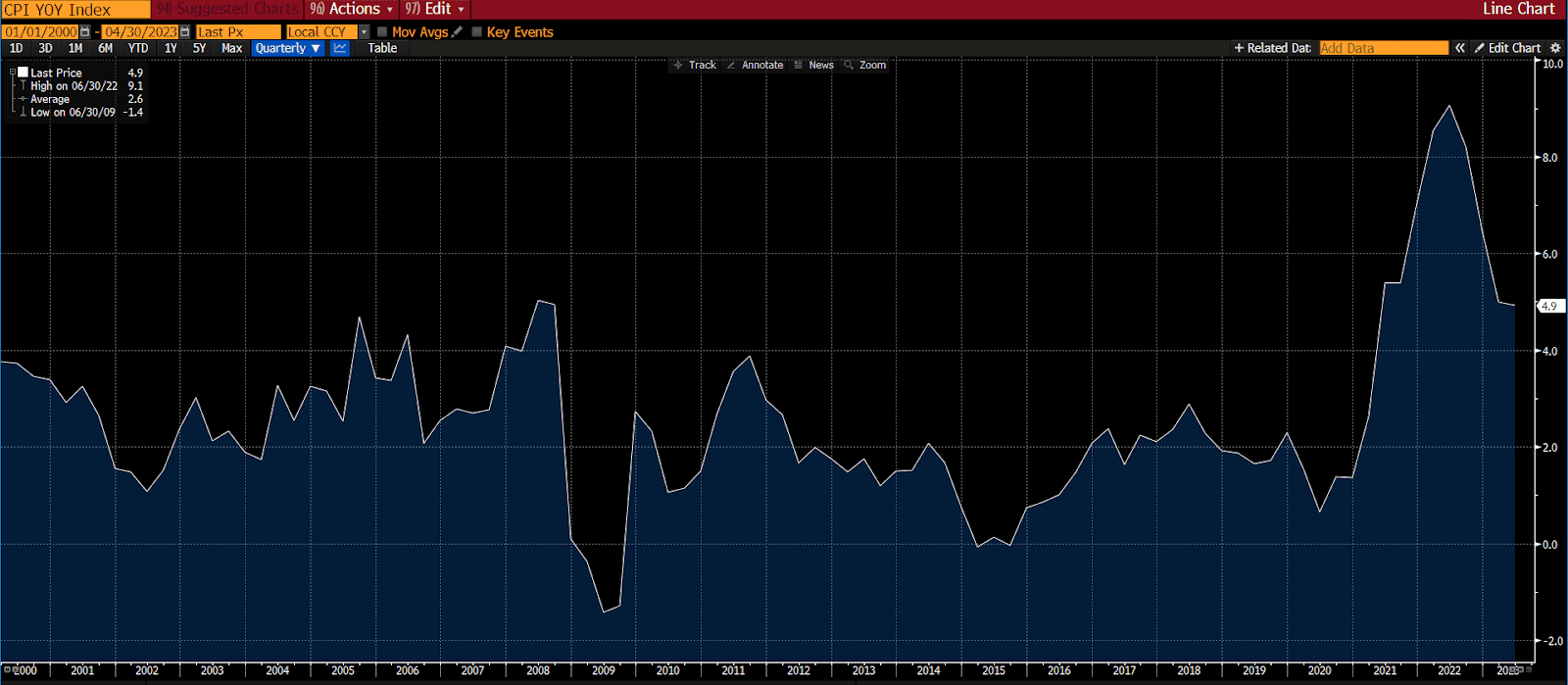

As for why bond yields have risen lately, it all comes down to interest rates. Interest rates set by central banks such as the US Federal Reserve and the European Central Bank (ECB) serve as a benchmark for borrowing costs. And, in recent years, rates have been extremely low. This is because, after the Global Financial Crisis of 2008/2009, the world’s central banks kept them at rock-bottom levels (they were negative for a while in some countries such as Switzerland and Denmark) in order to try to stimulate economic growth. The idea was that lower interest rates would encourage people and businesses to borrow more money, and kick-start growth.

However, with inflation increasing dramatically during the coronavirus pandemic, central banks have been forced to raise rates aggressively to try to get it under control. Recently, interest rates in countries such as the US and the UK have hit levels not seen for around 15 years.

Naturally, this sharp increase in interest rates has had a major impact on bond yields. Right now, there are opportunities in the fixed-income market that have not been seen for a very long time, with many high-quality securities yielding 5–7% or even higher. As a result, investors can now generate solid returns from the asset class.

*Past performance is not an indication of future results.

*Past performance is not an indication of future results.

INVEST IN YieldGrowth

76% of retail CFD accounts lose money

One-click access to a portfolio of bonds

To make life easy for investors seeking exposure to bonds, eToro has created the YieldGrowth Smart Portfolio. This strategy invests in exchange-traded funds (ETFs) that track well-diversified fixed-income indices to provide investors with access to a broad range of bonds issued by governments and corporations with good credit profiles.

The primary objective of the YieldGrowth Smart Portfolio is to maximise yields for investors. This is achieved through a disciplined investment process that identifies fixed-income ETFs offering attractive interest rates relative to their risk profiles. The aim is to capture opportunities across different sectors, issuers, and maturities, optimising the income generation potential of the portfolio and delivering a consistent and reliable stream of cash flow.

However, the strategy also seeks to generate sustainable long-term growth for investors. This is achieved by actively monitoring market trends, evaluating economic conditions, and identifying fixed-income ETFs that offer potential for capital appreciation.

Of course, capital preservation is an area of focus too. By diversifying across various bond issuers and sectors, the strategy aims to mitigate downside risk and provide stability during periods of market volatility.

Well suited to sophisticated investors seeking a robust fixed-income solution with the potential for both income generation and long-term capital appreciation, the YieldGrowth Smart Portfolio represents a straightforward way of adding bonds to an investment portfolio.

You can find more information on the YieldGrowth Smart Portfolio here.

76% of retail CFD accounts lose money

Sources:

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.