Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and ‘special’ focus on Golds vs digital gold.

Gold vs Bitcoin generational divide increasing

Generational change to increasingly undermine long term demand for gold, with younger investors strongly preferring Bitcoin vs older investor commodity and gold preference. Gold rally being driven by outlook for weaker dollar and lower bond yields, but with little validation from silver or gold stocks. Bitcoin driven by classic supply-and-demand squeeze and a pipeline of multiple catalysts ahead. See Page 4

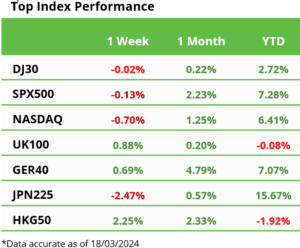

Stocks struggle with inflation stubborn

Stocks struggled as US inflation stayed stubborn, pushing up bond yields and the US dollar. With EUR retreating from a 1.10 test. Europe’s Stoxx50 (US$) now leads the S&P 500 this year. BTC broke $70,000 and equity proxies from MSTR onward soared. The semiconductor SOX index fell back. ORCL climbed on strong AI results. LUV plunged on BA deepening problems. See 2024 Outlook HERE and twitter @laidler_ben. See Page 2

US inflation and investor rotation

Inflation most important number in markets, and again disappointed, at 3.2%. But our tracker see’s disinflation and rate cuts. Catalysts for a second-half rotation away from big tech. See Page 2

The currency ‘carry trade’ is down not out

Carry trade been a big driver of FX returns, from MXN to USD. But now faces vice of US-led rate cuts and higher rates in Japan. But opportunities remain as carry trade changes. See Page 2

Peaks and valleys of global debt mountain

A rising investor concern but mixed blessing, with $300trn global debt but debt/GDP falling. Households and co’s are deleveraging, helping consumption and credit spreads. See Page 2

The widening gap in earnings quality

Earnings the most important stock price driver, and accounting is the ‘language of business’. But rising non-GAAP earnings measures and their gulf with official numbers a concern. See Page 2

Bitcoin breaks $70,000

Bitcoin broke to new high above $70,000 as spot ETF inflows hit record $1bn daily, with 35 days until four yearly halving event. ETH Dencun upgrade slashed fees and boosted scalability. MSTR bought 12,000 more BTC, and trades at big SOTP premium. ARKK took some profits in COIN. See latest Weekly Crypto Roundup. See Page 3

Higher oil offsets commodity struggles

Brent hit four-month high $85/bbl. on Russia refinery attack and lower US gasoline inventories. Broader commodities hurt by stronger dollar and higher bond yields, and lagging only bonds this year. Copper rose to $4.00/lb on China smelters cutbacks. Cocoa up 25% in month to $7,500/t. See Page 3

The week ahead: Central Banks, China, NKE

1) Central bank focus w/ Fed (Wed) dot plot risk, possible BoJ surprise hike (Tue) and SNB cut (Thu), w/ BoE pat (Thu). 2) Data deluge from flash PMI w/ EU est. exiting downturn, UK CPI and China Jan/Feb data. 3) Earnings NKE, FDX, MU, BMW, Tencent. 4) NVDA developer event. CERA Energy Week. TikTok US Senate vote. See Page 3

Our key views: Outlook for a different 2024

We see a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive an investor rotation from 2023 US and big tech winners to rate sensitive losers from Europe to real estate. See Page 5