Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and ‘special’ focus on the investment ‘style’ outlook.

30pp gap between best and worst styles

Investing in right investment styles, and sectors, matters a lot, with 30-46pp annual performance gaps. Last year was all about quality growth big tech outperformance. We look for a rotation in 2024. With Value, high dividend yield, small cap making a performance comeback. As the most sensitive to our GDP soft landing and rate cuts base case. Whilst retail investors are hanging onto their Growth and quality winners with high dividend yield a contrarian 3rd. See Page 4

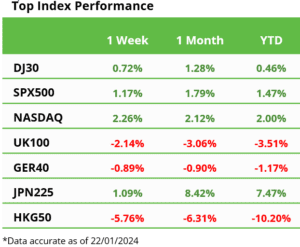

Tech comeback drives a new all-time-high

Tech stocks pushed S&P 500 to first new high in 2-years. As central banks pushed back on early rate cuts, raising bond yields and strengthening dollar. Whilst UK inflation and China growth reports hurt confidence. TSMC semis guidance boosted whole sector. CFR.ZU led a strong start to Europe earnings season. Whilst SAVE plunged as JBLU deal rejected. See our 2024 Outlook HERE and twitter @laidler_ben. See Page 2

Trade disruption not what it seems

Container rates doubled but is not 2021 supply shock that stoked inflation. Now smaller, more localised, specific, with worse demand + supply. Shippers should enjoy whilst lasts. See Page 2

Fed two-step and less Quantitative Tightening

Fed prepping to ease pace of QT and setting up for interest rate cuts, supporting bonds, not overly reducing system liquidity, and opening door for ECB and others to follow. See Page 2

Japan leads and China lags

Japan momentum as exit 30-yrs stagnation and deflation, breaking correlation with China, that’s been value trap on triple slowdown risks but offers risky contrarian turnaround. See Page 2

Renewables and EV’s glass-half-full

Underperformance back with demand concerns. Is high risk zero-to-hero turnaround opportunity on still very strong demand runway. See Page 2

BTC price pullback after ETF approval

Saw a double-digit BTC price fall since spot ETF approval, with TRX bucking sell off. BlackRock’s (BLK) IBIT first ETF to $1 billion of assets. Whilst giant fund Grayscale see’s outflows as converts at NAV. Ethereum (ETH) spot ETF process now in spotlight. Whilst COIN vs SEC case is in court. See the latest Weekly Crypto Roundup. See Page 3

Commodities remain under pressure

Squeezed by China growth disappointment and the stronger US dollar. Brent oil struggled to break $80/bbl. despite red sea tension and hiked demand outlook. Natgas price fell despite winter weather, with supply and storage high. Uranium spiked on more Kazakh supply fear and reactor demand. BP continuity on new CEO. See Page 3

The week ahead: Tech earnings, ECB, PMIs

1) Big tech Q4 earnings kick off, after banks, with TSLA, NFLX, ASML, SAP. 2) BoJ and ECB to keep interest rates unchanged as look to Fed (Jan 31). 3) Flash US, EU, UK, JP, and AU PMIs growth and inflation slowdown health-check. 4) The hard data focus on strong est. 2.4% US Q4 GDP and <2.9% ‘Fad favourite’ PCE inflation. See Page 3

Our key views: Outlook for a different 2024

See a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive an investor rotation from 2023 US and big tech winners to rate sensitive losers from Europe to real estate. See Page 5