Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and ‘special’ focus on big tech.

Beware of big tech crowding

An investment style rotation and the lessons of history warn against the current near record 28% S&P 500 crowding by big tech stocks. Change is the only constant among world’s largest stocks. Average time a stock stays in S&P 500 has near halved as disruption rises. Whilst none of the 1990’s global top-10 stocks are still their today. Tech is in the driving seat for now, but we see rotation this year on rate cuts and soft-landing, and inevitable threats further out. See Page 4

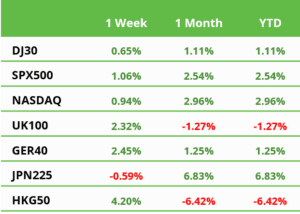

Goldilocks economics drives all-time-highs

US stocks set new all-time-highs and are set for a strong January, following a ‘goldilocks’ strong Q4 GDP growth but low 2% inflation data. Also saw dovish ECB interest rate hold and China RRR policy stimulus. Q4 earnings are beating lowered expectations, from NFLX to LVMH, but with TSLA and INTC notable misses. BTC falls below $40,000 on spot ETF rally hangover. See our 2024 Outlook HERE and twitter @laidler_ben. See Page 2

The widening services vs industry gap

A resilient consumer supports a services-led US economy, whilst industry-heavy Germany and China are in doldrums. This gap is widening but also hastening a policy response. See Page 2

Semiconductors are leading again

Chip stocks best performers this year, as last, as AI demand adds to smartphone turnaround and purged inventories. Valuations have rerated but buoyed by NVDA-led profits growth. See Page 2

Europe the earnings recovery guide

Europe’s earnings more depressed and cyclical vs US and will be first place to see the profits rebound we expect to drive markets. See Page 2

Enjoy the low gasoline prices, for now

Lower oil and refining spreads have given a welcome boost to the US consumer and inflation forecasts. But the outlook for higher oil prices later this year is now starting to firm. See Page 2

BTC falls back below $40,000

The Bitcoin spot ETF sell-the-news price reaction continued, making it the worst asset-class this year. IBIT and FBTC lead inflows at $1.7 billion+ with GBTC the $4 billion loser. ETH’s Dencun upgrade on track for end February. Crypto assets saw est. 150 million new holders last year. See the latest Weekly Crypto Roundup. See Page 3

Oil and China help commodities rise

Asset class helped by the twin drivers of China RRR cut economic stimulus, and hope for more, alongside strong US oil demand and rising geopolitical risks taking Brent crude price over $80/bbl. Uranium rally continued, on Kazakh supply fear and reactor demand view, and sugar rose on India drought concern. See Page 3

The week ahead: Tech profits, Fed, Month end

1) Biggest week of S&P 500 earnings w/ tech’s AAPL, MSFT, GOOGL, META. 2) Fed (5.50%) and BoE (5.25%) to keep rates unchanged w/ focus on rate cuts outlook. 3) Macro focus on weak EU Q4 GDP, low <3% inflation, and easing est. 160k US payrolls (Fri). 4) Markets set for positive January, setting up well for rest of year. See Page 3

Our key views: Outlook for a different 2024

See a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive an investor rotation from 2023 US and big tech winners to rate sensitive losers from Europe to real estate. See Page 5