Please see this week’s market views from eToro’s global

Sentiment rebound puts focus on earnings

The strong investor sentiment rebound seen this year has helped drive markets up and taken valuations above average levels. This puts the market focus on the building earnings recovery. Institutional investors have been the most cautious on the rally. Whilst retail investors took the long view and never gave up on tech. But companies still biggest buyer of US stocks. Our eToro investor sentiment tracker is a contrarian indicator flashing a yellow warning. See Page 4

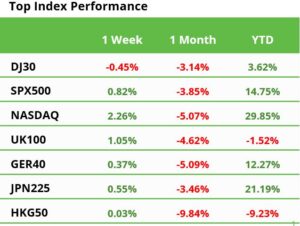

August set for sharp losses

Stocks stabilised but are on track for -5% August losses. Cross-currents of sharply weaker global growth PMIs, a hawkish Fed’s Powell Jackson hole speech, and some easing of surged 10-yr bond yields. Stocks saw another blowout NVDA results quarter, and ARM filed for a Sept. blockbuster IPO. But also saw big post-results retail sell-offs from FL to PTON. See Q3 Markets Outlook HERE and at twitter @laidler_ben. See Page 2

A last consumer hurrah

Back-to-school/college spend rivals Christmas in size and last consumer hurrah as pressure builds and GDP growth expectations can only fall from current 40-yr highs. @ShoppingCart. See Page 2

Did the ‘September Effect’ come early?

September close and typically weakest month for stocks. But ‘September effect’ may been pulled into August, as now well known, and setting up for typical Q4 repositioning rally. See Page 2

Heat, drought, and hurricanes

Investors face potentially one of most powerful El Niño events in history, boosting commodities and extreme weather stocks. See Page 2

Testing the IPO market

ARM, Birkenstock, Instacart are a coming test for weak but recovering IPO market. But the number of US stocks is down 40% from peak and limited supply helping keep valuations high. See Page 2

Crypto depressed after flash crash

Asset class depressed, with BTC around $26,000, after the SpaceX sales triggered ‘flash crash’ and continued broader global markets volatility. TRX outperformed on its steadily lower supply. Whilst XRP held back by the SEC lawsuit appeal. The Bitcoin hash-rate is at a new all-time-high, whilst Ordinals subscriptions hit 25 million. See Page 3

Commodities mixed on PMIs and dollar

Hurt by surprisingly weak global flash PMIs and a 3-month Dollar high. Brent oil fell under $85/bbl., on Iran and Kurdistan supply outlook. Whilst EU natgas price plunged as Australia’s LNG export strike was avoided. Ag prices, from sugar to coffee and cotton, rose again partly on El Nino weather supply disruption fears. See Page 3

The week ahead: Payrolls, inflation, and tech

1) Focus on slowing US payrolls (Fri) <200k and EU inflation (Thu) to <5%. 2) Tech and consumer earnings from CRM, AVGO, LULU, CHWY. 3) Start of seasonally weak Sept. (Fri), after poor August. 4) Holiday shortened UK week with FTSE 100 rebalance and lower house prices. See Page 3

Our key views: A positive markets breather

Market seeing breather after strong 1H, with weaker seasonality, low volatility, and coming growth slowdown. But fundamentally positive on lower inflation and coming rate cuts. Focus on defensive growth and long duration assets from healthcare to big tech. Cautious growth exposed cyclicals, commodities, and banks. See Page 5