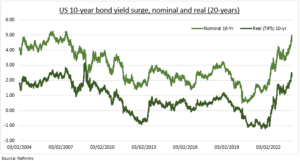

BREAK: US government bond yields, the bedrock of modern finance, had an unprecedented surge (see chart). This stokes concerns ‘something will break’ in markets. Similar to Sept. 2022 liability driven investment (LDI) scare in the UK, or March 2023’ US small banks rout. The usual suspects are the coming maturity walls for commercial real estate and high yield corporate debt and the squeeze on smaller banks. These are stressed but well-known. With any surprise more likely to come from left-field, like private US credit markets or Europe’s peripheral sovereigns. The caveats are the world has got increasingly used to this high uncertainty ‘new normal’ and central bank rate cut ‘puts’ coming back as investor insurance with underlying inflation cooling.

MATURITY WALL: Worries focus on well-known risks like commercial real estate (CRE) and high yield corporate debt (HY). They face big and perennial ‘maturity wall’ concerns as need to refinance at higher rates into a weakening economy. This CRE wall is seen at up to $500 billion this year and next, whilst for HY it stands at $100 billion this year and double that next, per S&P. Yet real estate markets are already braced for this, with listed office REITS down 31% this year, and alternative capital providers like private equity and large banks with ‘dry powder’. Corporate high yield spreads have been very well contained, and fundamentals stayed relatively robust.

BANKS: US banks continue to be squeezed by a perfect storm of ‘dash-for-cash’ deposit outflows, a net interest margin hit from rising ‘deposit beta’s’, slowdown risks raising loan loss provisions, and now more bond portfolio losses. These unrealised bond losses stood at $560 billion before the latest yield spike, per the FDIC. Yet, the Fed stands behind the sector, with its Bank Term Funding Program at a record $109 billion. And investors know the risks, with the US regional (KRX) and mainstream (BKX) bank ETFs down 28% this year and near the May lows.

All data, figures & charts are valid as of 24/10/2023.