WOMEN’S DAY: Friday is International Women’s Day (IWD). A reminder of the significant progress women have made in business and markets. But also, the long road ahead. The roots of IWD are traced back to 1909 but it went mainstream after being named a global holiday by the United Nations in 1977. Women make up a record 10% of Fortune 500 CEOs in the US today. But this still dramatically lags all other areas. With women 28% the US Congress, 34% of Federal judges, 37% of doctors, and 48% the workforce. Whilst the number of female investors is booming, and they invest differently and more successfully than men. @FemaleLeadership.

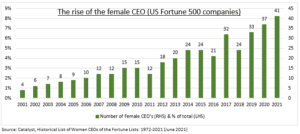

BUSINESS: The number of Fortune 500 companies with a female CEO rose to a record 52 last year and broke the 10% barrier for the first time (see chart). From Mary Barra of General Motors (GM) to Jane Fraser at Citigroup (C), Safra Catz of Oracle (ORCL) and Lisa Su of AMD (AMD). But overall, women are estimated to still earn an average 17% less than men in the US. And this low proportion of women CEO’s is not a US outlier. Similar to the UK FTSE 100, like Emma Walmsley at GSK (GSK.L), or Germany’s Dax, with Merck (MRK) CEO Belen Garijo. Globally, the World Bank estimates women have only 18% of senior management roles, led by Asia.

MARKETS: The number of female investors is booming, according to our latest retail investor survey of 10,0000 DIY investors across 13 countries. Up 30% in the past two years versus the 21% growth rate for men. Women also invest differently. They are more cautious, with fewer tech, AI or crypto investments. More focused on financial security goals and on managing downside risks. And without the levels of (over)confidence often seen with male investors. This is consistent with the academic studies showing that women are better savers and generate better investment returns on average, by being more cautious and diversified and trading less.

All data, figures & charts are valid as of 06/04/2024.