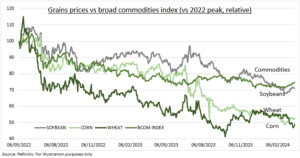

LOWS: Cereals prices have halved vs their 2022 peak after Russia’s invasion of Ukraine. Whilst soybean prices have fallen more than broad commodities. All three are near three-year price lows. Pressured lower by the dollar rally and supply glut from big South American and Russian harvests. This has been a major driver of lower food prices across the world, where they provide 1/3 global calories. A relief to consumers and inflation-focused policymakers. But piling pressure on farmers and their suppliers. The bull case is that ‘low prices is the solution to low prices’ as plantings adjust. And investor sentiment already the most bearish since 2006. @AgriWorldWide.

CONTEXT: Corn and wheat dominate total global calorie consumption, and soybean meal is the major protein for animals. Wheat exports are driven by Russia (24% of total), followed by the EU (18%) with Canada, Australia, and US all 9-10% each. The US has long been the largest corn producer, consumer, and exporter. But ag-superpower Brazil eclipsed it last year, at 32% of world exports. It’s used across the food industry as a starch, for fuel ethanol production, and as animal feed. Soybeans are the most traded commodity after oil, and this ‘miracle bean’ used in a huge array of human products and animal feeds. Brazil and US dominate soybean exports.

ASSETS: Low prices have been great for consumers and policy makers worried about inflation. Lower food prices led recent downside inflation surprises across the world, from US to UK. With headline inflation much lower than core prices that excl. food and energy. Emerging markets (EEM) are the most benefited. Where food is less processed, represents more of disposable income, and a 3x bigger weight in inflation baskets than developed markets. But farmers and suppliers are hurting. With a spike in Brazilian farmer bankruptcies. And supplier profit warnings and stock price weakness from tractor giant Deere (DE) to nitrogen fertilizer’ CF Industries (CF).

All data, figures & charts are valid as of 21/03/2024.