SURPRISE: Japan is a global top 3 economy, stock market, and most traded currency. It has traditionally been out-of-mind for many. But it provided this year’ Christmas ‘surprise’, and these may continue in 2023. Bank of Japan (BoJ) widened its yield curve control (YCC) band on 10-yr government bonds from 0.25% to 0.50%. This first step to belatedly tighten monetary policy will continue as Governor Kuroda retires in April, and the economy accelerates this year. This may start to attract capital back to Japan, including its $1.1 trillion of US treasuries, and further boost a still-cheap Yen. A negative stock impact may be offset by low valuations and China’s recovery.

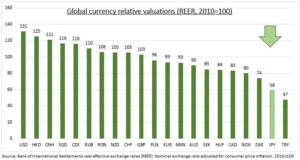

YEN: JPY/USD led big currencies down last year with a 23% plunge through early Q4. Interest rate differentials soared, as the Fed aggressively hiked rates, and global risks rose, driving safer haven USD demand. Since then, JPY has rallied 12% as the BoJ intervened to blunt its fall, and followed up with December 20th’ baby step to tighten policy. It remains the world’s cheapest big currency (see chart), and the growth and interest rate outlook gives support. We focus on Jan. 18th’s BoJ meeting, and the naming of Kuroda’s replacement ahead of stepping down April 8th.

NIKKEI: Japanese stocks (JPN225) have been held back by the recent Yen strengthening. Yen weakness was a key competitiveness and profitability buffer to Japanese stocks facing poor domestic growth and some of the world’s lowest profit margins. But the Yen remains cheap and its strengthening likely to be balanced by Japan and China’s unique economic growth pick up, cheap valuation (12.5x P/E), net-cash balance sheets, low correlation with other markets, and its many world leading stocks – from Toyota (TM) to Sony (SONY). See @AsianDragons.

All data, figures & charts are valid as of 05/01/2023