MACRO: It’s been a good US results season, with earnings up 8% and 80% stocks beating forecasts. It’s been the twin pillar of May’s rebound and this nascent bull market, alongside coming interest rate cuts. The last big earnings hurrah is Wednesday from AI and chips giant NVIDIA (NVDA). It’s become a macro event given its significance, size and record of results beat-and-raises, with booming AI demand and pricing power. But this has stoked expectations ever higher, and it will disappoint eventually. This wouldn’t be the end of the world. Accelerating the ongoing market broadening, and a little reallocation going a long way elsewhere see chart).

RESULTS: Consensus Q1 forecasts are for over $24 billion in sales versus under $7 billion a year ago. And for earnings to more than quadruple. The expectations ‘whisper number’ is likely higher. Results will be driven by its booming data centre and AI GPU businesses. The stock is coming off a string of earnings beats and guidance raises. And is in a sweet spot of insatiable first-mover demand and capacity-constrained pricing power. The stock is up 90% this year and trading at a full but not overly demanding 35x forward Price/Earnings valuation. Many chip stock peers are much more expensive than that, from ARM Holdings (ARM) to Super Micro (SMCI).

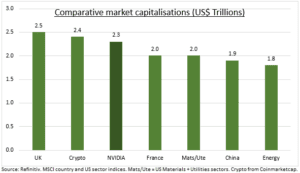

MISS: Magnificent 7 stocks are a record 30% of S&P 500 market cap. And singlehandedly driven earnings growth this quarter. NVIDIA has beaten forecasts and raised guidance for the last few quarters. Making it tougher to beat every time as expectations are raised. And options braced for a 8% price swing either way. It’s a concerning set up. The two offsets are. 1) Markets are better prepared now with performance broadening out from just US big tech. And non-tech earnings are seen taking the growth baton up in coming quarters. 2) An NVIDIA earnings miss may accelerate this started rotation with a little money going a long way in these smaller assets.

All data, figures & charts are valid as of 20/05/2024.