VALUATIONS: We are positive on the resilience of the super-sized US stock market. But its combination of already high profitability and above average valuations limits the upside. These are the only two-levers of stock performance. This means the magnitude of this bull market may be lower than the long-term average of near 150%. And that the relative upside from here is increasingly elsewhere. Much of the rest of the world, and many cyclical sectors, still have a double earnings and valuation upside combo, and clearer rate cut and growth rebound catalyst. Their wider than average valuation discounts offer upside potential and downside protection.

RELATIVE: The US is expensive for a reason. With higher GDP growth, a big tech sector, and strong governance. Tech deserves its high valuation. With huge profitability, balance sheet strength, and outsize growth. Whilst Europe’s valuation is justifiably held back. By higher debt and more cyclical index composition alongside lower growth and profit margins. You cannot compare apples with oranges. The question is the size of the gap. Europe’s Stoxx 600 and FTSE 100 price/earnings discount is now 15pp and 20pp wider than the 10-yr average 20% and 25%. Chinese stocks are 20pp cheaper than the average 35%. Yet not everything has changed. The 2nd largest US financial sector, for example, is still on an average 28% discount to US tech.

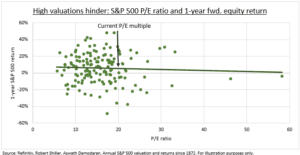

MATTER: Valuations matter, especially over the longer term. Our plot of 150 years of US stock market valuations versus 1-year forward returns (see chart) shows the odds turning against you at current high valuation levels. And this only worsens over time as the correlation between the two significantly increases. Simplistically, lower valuations have more room to rise when times are good. And less room to fall when the fundamentals turn against you. Whilst lower valuations are also a technically positive contrarian sign of stocks being under-owned and out of favour.

All data, figures & charts are valid as of 25/04/2024.