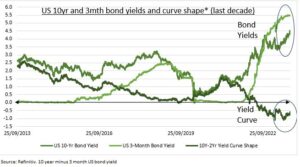

CURVE: The US 10-year bond yield has risen above 4.5%, to its highest since 2007. This has piled pressure on stock market valuations, depressing the ‘future value of future cash flows’, and widening the current S&P 500 premium versus fair value to 30%. It will also tighten financial conditions and pressure bank balance sheets. This ‘bear steepening’, with long term yields rising faster than short term, can also be seen in Europe. But it’s not all bad, as it reflects higher economic growth, hence earnings, expectations. And we are cautious on the sustainability of this bond yield (TLT) shock, and current yields, with inflation break evens and global growth proxies like copper unchanged, and US financial conditions to tighten and slow the economy.

BEAR STEEPENING: The recent US yield curve move can be characterized as a ‘bear steepening’, with long term yields rising more than short term yields, hurting stock markets. As opposed to a ‘bull steepening’. Where short term interest rates fall faster as the Fed is expected to lower interest rates, helping stocks. Now the bond market is signaling a more resilient economy. But it’s also cautionary as higher long-term yields will tighten financial conditions, from mortgage rates to banks market-to-market bond portfolios. A steeper curve typically boosts growth sensitive assets like Value (IWD) and energy (XLE). We don’t think this is sustainable.

SHAPE: The bond yield curve has three basic shapes. 1) Inverted: Its current and rare shape. With long term yields below short term yields for the last 14 months, as bond investors forecast a sharp economic slowdown or recession and lower inflation. 2) Flat: Implies uncertainty, often seen at the end of a high growth period, that has raised interest rates, with fears of a growth slowdown holding down long-term yields. 3) Upward sloping: The norm, with higher bond yields on longer maturities compensating for the inherent greater inflation and growth risks.

All data, figures & charts are valid as of 26/09/2023.