GROWTH: US wage growth has been running at multi-decade highs of over 6% since March 2022. It’s been led by the younger, the less qualified, and the lower paid. Leisure and hospitality, and education and health, have been amongst the biggest beneficiaries. This has been a net benefit for companies. Rising wages support consumer spending, by far the biggest proportion of the economy. And real wages are now rising, with headline inflation fallen back to 4%. But rising labour costs have hurt profit margins and started to rebalance GDP back toward labour from capital. It’s also helping keep core inflation stickier than hoped. But so far, the demand boost is offsetting any hit to margins, and driving investment in productivity, AI and automation.

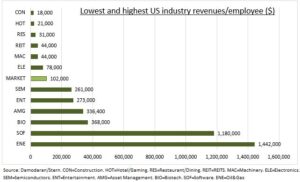

PRESSURE: We examine employee and revenue data from across US industries. We highlight those with the highest and lowest revenues per employee (see chart) versus the market average of around $100,000. This is a proxy for the sensitivity to sustained higher wage costs. It includes construction, hotels/gaming, restaurants, real estate, machinery, and electronics. Unsurprisingly some of these sectors have been among the leading adopters of automation. By contrast the least directly impacted sectors include oil and gas, software, biotech, asset management, entertainment, and semiconductors. They are significantly less wage sensitive.

MARGINS: S&P 500 index profit margins have fallen from a Q2 2021 peak of 13.0% down to 11.5% last quarter, which is close to the long term average. Rising wages and producer prices have undoubtedly been a part of this. Though the impacts are likely greatest amongst the smaller companies not in the S&P 500. Big company pressures are manageable with labour costs under 15% of sales. Sectors with low sales/employee like discretionary and industrials are actually among those seeing wider margins, highlighting the impact of rising wages on sales.

All data, figures & charts are valid as of 13/06/2023