BRACED: US inflation is the most important number in markets. And markets seemingly braced for a hot US February inflation print today. After January’s upside surprise and Friday’s inconclusive jobs report. We are calmer. Our inflation tracker is more dovish. Rate cut forecasts are now in-line with the Fed. Inflation break-evens already moved up. And investors are looking at the rotation to come as we get nearer rate cuts. Away from the US dollar and tech. To cheaper and more cyclical overseas assets. Markets are priced for 4 cuts starting Jun 12th. With ECB first to cut Jun 6th. Fed is in blackout ahead of its Mar 20th meet with new dot plot forecasts due.

NOWCAST: The Cleveland Fed inflation NOWCast is in line with the more cautious market consensus. With the February headline increase cooling to +0.4% MoM but stable at +3.1% YoY. As an easing ‘January effect’ of annual price rises rolls off, but gasoline prices rebounded higher. Whilst core prices, excluding energy and food, are seen at an above-consensus 3.9%. The NOWCast also sees annual inflation rates as flat-to-higher next month. This is in contrast to alternative indicators like the Truflation measure at 1.7%. This is a real-time blockchain-driven inflation tracker from 30+ sources and 13+ million prices that consistently tracks below CPI.

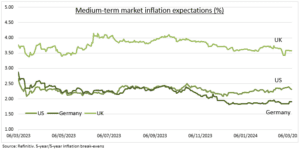

TRACKER: Our tracker of 13 leading and coincident indicators shows an easing of pressures. It’s -40% from peak 2022 levels and -0.8% the past month as a narrow 7/13 indicators fell. This was a turnaround from the prior month of broad pressures. Now an ease in forward-looking PMI employment and prices paid indicators is being balanced by rising gasoline and housing market pressures. We track labour (employment ISM, JOLTS), housing (Zillow rent, NAHB index), goods (Used cars, Manufacturing ISM prices), commodities (Gasoline, broad commodities), supply chains (GSCP index, container rates), and expectations (Michigan survey, Break-evens).

All data, figures & charts are valid as of 11/03/2024.