CAUTION: Physical commodities have been the best performing asset class in each of the past two years, measured by the broad Bloomberg commodity Index. And seems a 2023 consensus pick. We are more cautious. Prices peaked in mid 2022 in line with historic rallies. Recessions have been their typical undoing. Whilst its diversification benefits are now less clear. A weaker dollar, stronger China, green-transition demand, and chronic underinvestment all give support. This should keep prices ‘high-for-longer’. But exposure may be better through forward-looking related equities than physical. The asset class is unlikely to see a ‘three-peat’ leadership year.

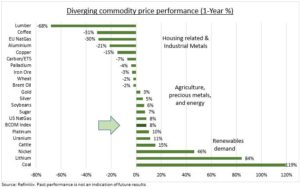

CYCLES: The average of commodity upcycles in the past fifty years lasted 33 months with a 150% increase. If June 2022 was the latest peak it was only a little short. Lasting 27 months, with a 125% rally. Overall prices are down 20% from their 2022 highs but still over double long term average levels, and with clear supports to the increasingly threatened demand view. This still remains a good environment for many commodity producers. Whilst related equities are some of the cheapest in the market, with strong capex discipline, dividends and buybacks.

OUTLOOK: Real assets like commodities are closer tied to near term supply and demand than more forward looking ‘financial’ assets like stocks and bonds. This is challenging with economic growth and inflation falling, and interest rate cuts on the far horizon. Investors may also be less attracted by commodities low cross-asset correlation after an outlier year of bond and equity weakness. Energy and metals tend to move together. They have similar growth drivers, are often close substitutes, and energy a key input. This is less the case for ag and precious metals.

All data, figures & charts are valid as of 04/01/2023