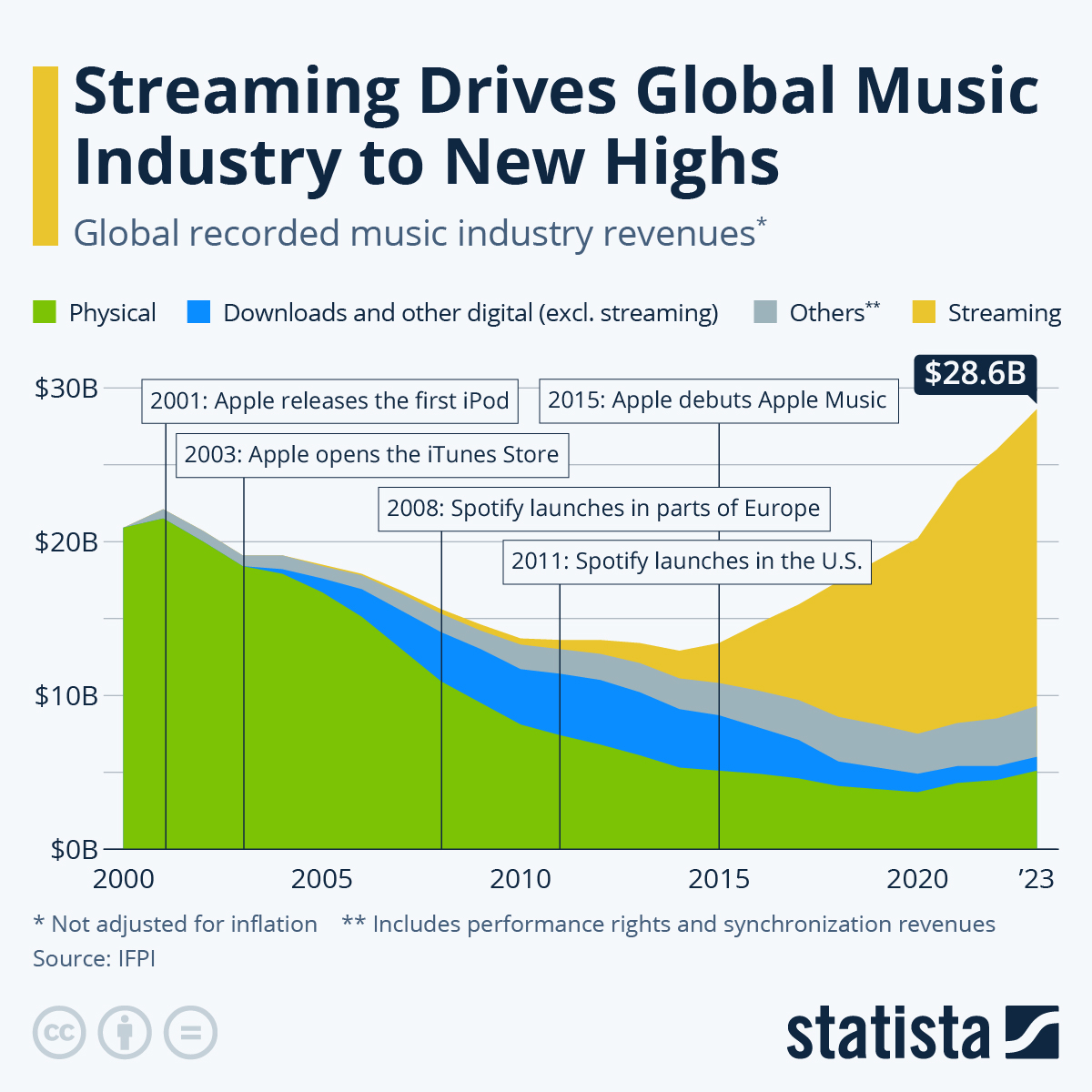

Music is a universal language which easily crosses borders, cultures, and generations. This universal appeal has made the music industry a highly scalable business, with large potential for growth. Over the past few decades, the industry has seen large changes, shifting from physical media to digital downloads and now to streaming platforms, see figure 1. Currently various streaming platforms are in a heated battle for users and market share. At the same time large players have focussed on owning and monetizing music and do not care much which platform wins. This approach, combined with monopolistic tendencies and annuity-like income streams (where songs continue generating revenue years after release) can turn companies into interesting long term investments given the right price. Universal Music Group ($UMG.NV) stands out as one of the biggest players in the industry and will be the main focus of this article as it has shown a stellar 40% average ROE since spin off.

Figure 1: The recorded music industry over time, Statista1

Business profile

Many independent artists now release music directly, but most still prefer working with labels like UMG for the added support. UMG helps artists focus on their music while providing essential services across three key segments:

- Recorded Music: UMG’s largest revenue driver, covering artist discovery, music production, and promotion. It handles digital and physical distribution, streaming revenues, and monetizes an extensive catalog.

- Music Publishing: Manages songwriters’ rights, licenses music for media, collects royalties, and fosters creative collaborations to maximize opportunities for compositions.

- Merchandising and Other: Builds artist brands through branded merchandise, concert-related sales, and partnerships with major companies for sponsorships and co-branded ventures.

The investment case

Streaming

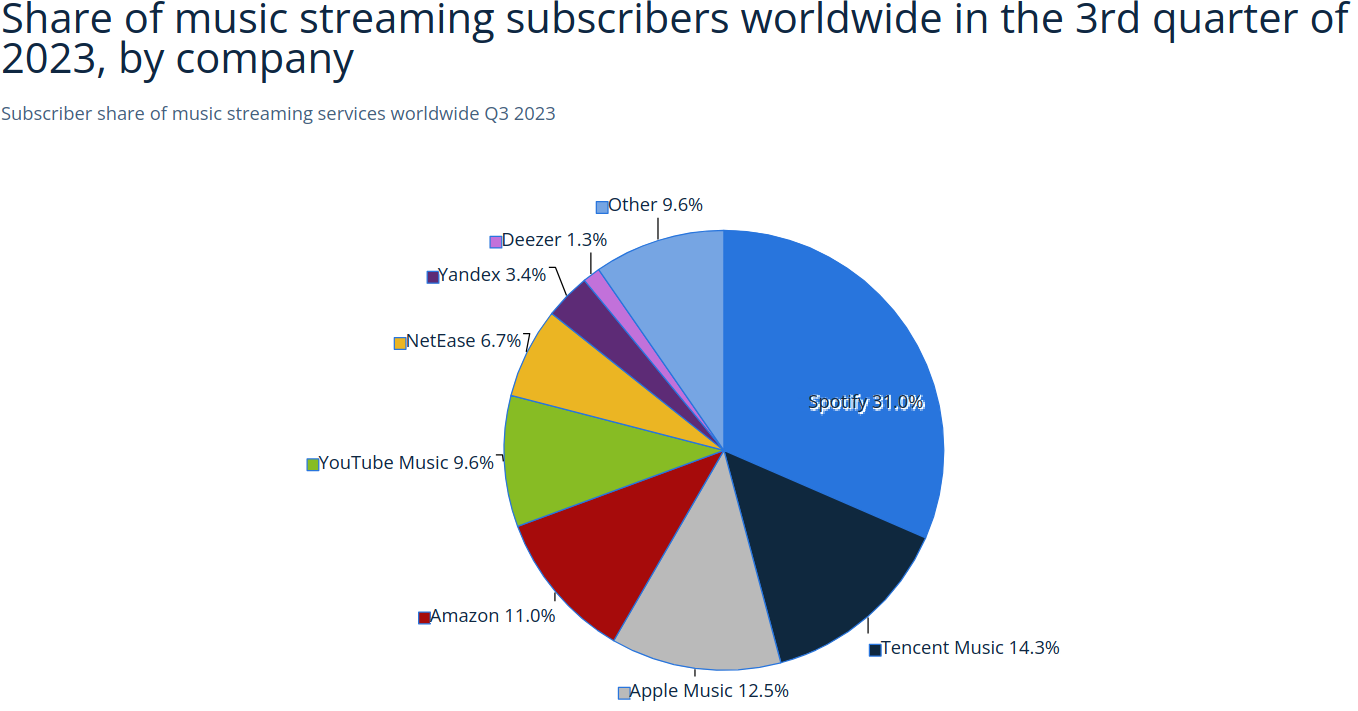

Streaming has become the main way people consume music, but it is a very fragmented market (see figure 1 and 2). Platforms like Spotify are spending billions on marketing to expand their user bases. Interestingly, this aggressive spending benefits labels like UMG, as it increases the overall size of the music market and most of that subscription revenue is passed on the the labels anyways.

As streaming becomes more accessible, UMG stands to gain significantly without bearing the cost of marketing to grow the pie. Additionally per capita spending remains well below its 1999 peak. To match those levels, spending would need to double, creating substantial room for growth.

Figure 2: Streaming market distribution, Statista2

Competitive landscape

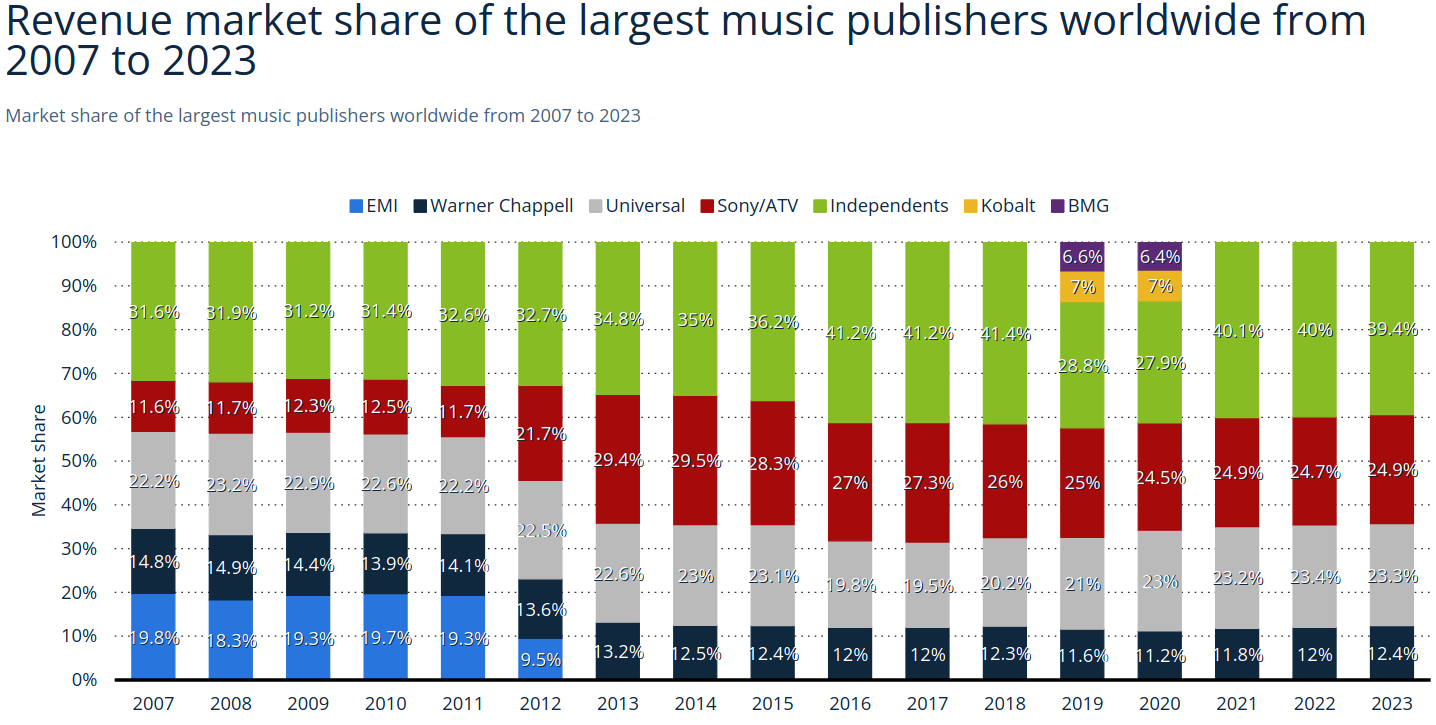

UMG competes with Warner Music Group and Sony Music in an industry where market shares have remained relatively stable since UMG’s 2021 spinoff, see figure 3. These companies operate in a competitive yet collaborative environment, prioritizing margins over risky market-share battles. This dynamic ensures UMG’s negotiating power with streaming platforms stays intact. UMG’s negotiating power was tested when TikTok attempted to secure better terms last year, but UMG managed to increase royalty rates and strengthen protections against AI-generated content3.

Figure 3: Market share for music publishers, Statista2

Financial summary

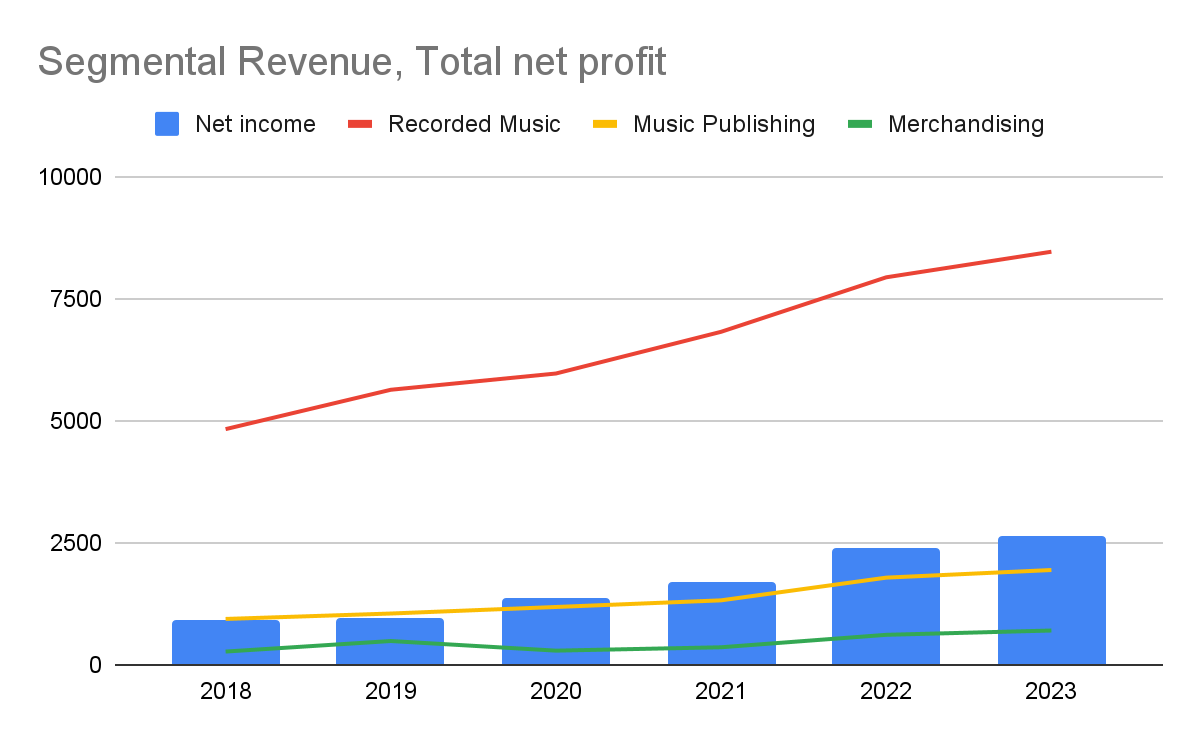

Over the past few years, all segments have shown steady growth, reflecting UMG’s ability to adapt to market trends and expand its global presence. Since its spinoff in 2021, UMG has reported consistent increases in revenue across these segments, supported by strong catalog performance, streaming growth, and strategic acquisitions. This growth has driven a rise in net profits.

Chart 1: Historical data from UMG financial reports, in EUR million

Investors panicked in July last year as a slowdown in streaming growth..

However, I believe this to be a temporary setback rather than a long-term concern.

UMG’s balance sheet has large amounts of intangibles and interest can easily be covered.

Valuation

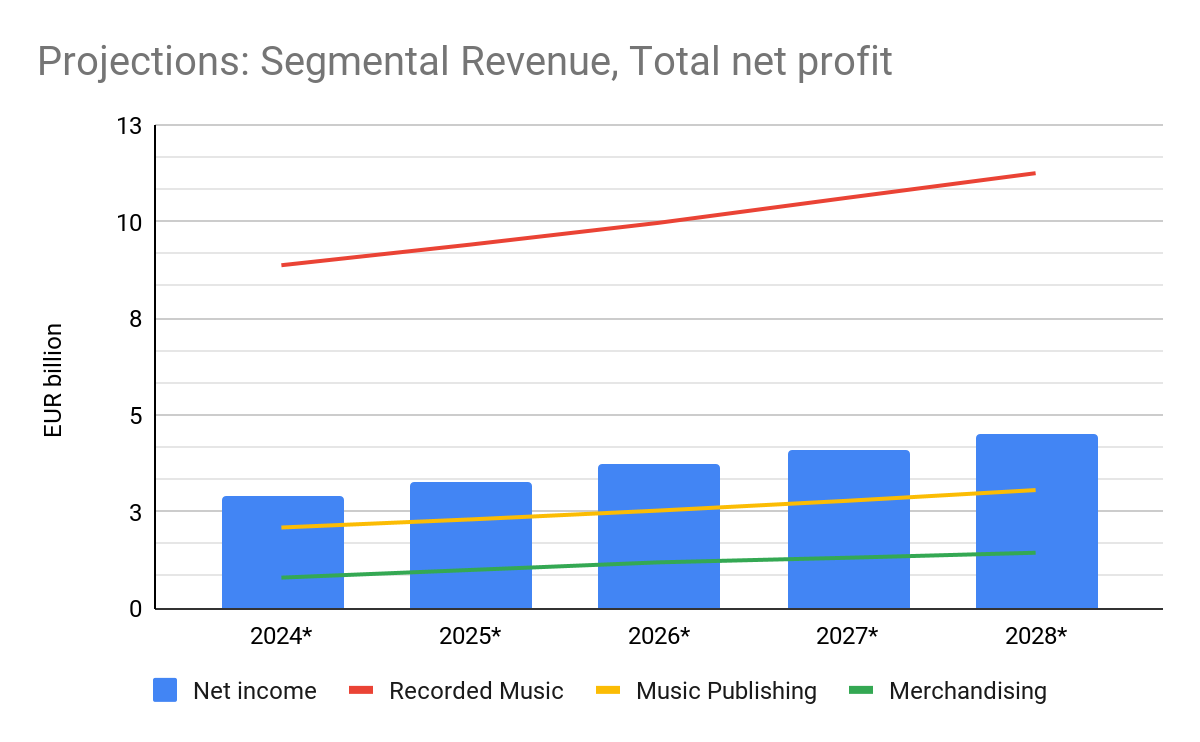

In my opinion a company being under or overvalued should not hinge on small tweaks in models, especially given all the uncertainty around future cash flows. Therefore I take both qualitative and quantitative aspects into account whenever making an investment decision. In order to obtain a general idea about the valuation of UMG I perform a simple reverse discounted cash flow (DCF) analysis and simple annual rate of return (ARR) calculation. The basis for both are my own projections for the next few years, see chart 2, based on industry trends, earlier earnings and market forecasts. My aim is not to be spot on with these projections, I however do try to be in the general ballpark of what UMGs top and bottom lines will be in the next few years.

Chart 2: Forecasts by the author

Reverse DCF

The aim is to compute the discount rate the market is providing. This discount rate is called the internal rate of return (IRR). Inputs are future profits, a 3.5% terminal growth rate, net cash and expected share counts. I arrive at an ~8.2% IRR.

ARR

An ARR calculation can provide a quick insight into the valuation as it illustrates more clearly what the ending multiple will mean for your investment. The ARR given a multiple compression to 25x 2028 earnings would be ~9.7%, similar to the IRR this provides a decent margin of safety.

| 2024 | 2025 | 2026 | 2027 | 2028 | Ending EPS | Expected ending multiple | Current price |

|---|---|---|---|---|---|---|---|

| €0.87 | €1.00 | €1.10 | €1.17 | €1.32 | €1.32 | 25x | 24.22 |

Table 1: Author’s forecasts, price as of writing

One could use NOPAT, FCF or other metrics but I chose to use net profit for the DCF/ARR.

Risks and uncertainties

As mentioned throughout the article the future is not known and I sadly am not in possession of a crystal ball. Several items pose substantial risks to the investment thesis.

Company specific (idiosyncratic)

The most obvious risk is that UMGs current and future artists might not perform well. Failure in marketing, song writing, controversies or just bad luck could materialize this risk. Additionally UMG might make missteps in acquisitions or financial decisions.

Industry

Furthermore UMG could lose its strong negotiation position towards platforms such as Spotify. If such players manage to cement their position and labels like UMG become more dependent on them they can put pressure on UMGs margins. Likewise AI music just like piracy can demonetize users.

Macroeconomic

While music is very important to people’s lives, nobody will hesitate to reduce music spending in order to buy food or pay for utilities. Thus if the global (but especially UMG core regions like the US and Europe) economy weakens this can pose a threat to income. Interest rates impact valuation and the returns of acquisitions and investments done by UMG.

Conclusion

While UMG is able to create significant value, the multiple given does not make it the cheapest stock in the market. Nonetheless given the risk profile, lack of correlation with other businesses and an expected 8-9% return with relatively conservative assumptions I think UMG is an attractive stock to have in my portfolio. Less technical, owning a medium growth, high margin business with monopolistic tendencies at a multiple quite below the S&P 500 sounds like music to my ears. The cherry on top being that Dutch dividend withholding is subtracted from my taxes at the end of the year as a Dutch investor.

This analysis is for informational purposes only and should not be considered financial

advice. The author of this analysis holds shares in Universal Media Group, which may influence the perspective provided. Please conduct your own research or consult with a financial advisor before making any investment decisions.

Sources besides UMG financial reports used in this article:

- Statista (Mar. 2022) Streaming Drives Global Music Industry to New Highs https://www.statista.com/chart/4713/global-recorded-music-industry-revenues/

- Statista (Dec. 2024) Music industry worldwide https://www.statista.com/study/136828/music-industry-worldwide/

- WSJ (May 2024) The Universal Music-TikTok Spat Is Over. Here’s What Artists Won. https://www.wsj.com/business/media/universal-music-artists-to-return-to-tiktok-after-new-licensing-agreement-4c1d4e42