GROWTH: US economic growth has continued to be a big positive surprise. Whilst core inflation has been sticky. Despite one of the shortest and sharpest interest rate hiking cycles in history. Economist Milton Friedman wrote about these ‘long and variable lags’ in transmitting higher interest rates to a slower economy back in 1982. His study of 18 business cycles over a century showed a wide lag of between 4 and 22 months. We are now 18 months from the first March 2022 Fed hike. Two elements delaying the transmission, where the US is a global outlier, are 1) a high proportion of fixed rate debt and 2) long maturities. This delays, not postpones, the coming growth slowdown. We stay focused on long duration assets, and are cautious cyclicals.

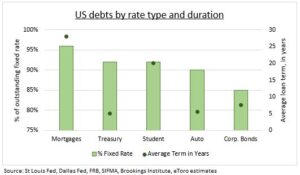

FIXED: The vast majority of company and consumer debts are fixed rate (see chart), delaying the impact of the Fed cycle. 85% of the corporate bond market, where most big companies fund themselves, is fixed interest rate. By contrast, most European and Chinese stocks finance themselves with often floating rate bank loans. Similarly, most of the $17 trillion of US consumer debts are fixed rate. The US is a global anomaly with nearly all mortgages 30-year fixed rate, whilst both auto and student loan rates are mostly fixed. The only sizable exception is the $1 trillion credit card market, where rates are floating and already very high. Similarly, an estimated 92% of US government debt is fixed rate, with only 6% inflation-protected and 2% floating rate.

MATURITY: Consumers and companies have also been partly shielded by long debt maturities. Companies refinanced aggressively at very low interest rates in the 2020 pandemic. When bond issuance spiked 60% to a $2.2 trillion peak. This has helped lengthen average corporate bond maturities from 4.8 years to 7.5 years over the past decade. Mortgage maturities are 30-years, student loans typically repaid over 20-years, and Auto loans have an average term of 5.5 years.

All data, figures & charts are valid as of 07/09/2023.