Summary

Déjà vu return to 2022 winners

More volatile markets and higher bond yields argue for a new look at the 2022 winning sectors that lagged this year. Traditional defensives, like healthcare, defence, or high dividend, but also surprises, like airlines. Financials are one of the biggest winners of current macro setup. Need more discrimination within the outperforming but pricier tech sectors. See select opportunities only in energy and weak real estate.

Stocks resilient to rising bond yields

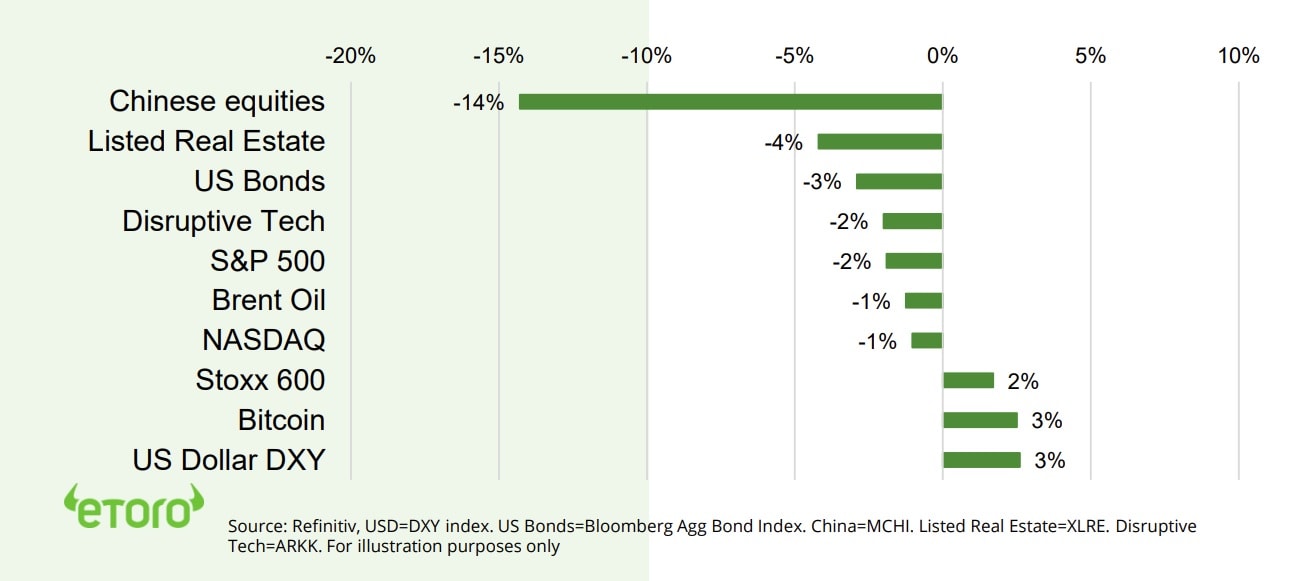

After falling in February, stocks resilient to US 10- yr bond yields breaching 4% and Europe’s core inflation rising to 5.6%. As China PMI showed its reopening gathering pace. The US dollar eased, commodities firmed, and bitcoin fell. Corporate news saw the TSLA investor day disappoint, LLY slash drug prices, and CRM surge after strong results. See our 2023 Year Ahead HERE. See video updates, twitter @laidler_ben.

Two months down and ten to go

Markets February reality check. Sticky inflation and firm economies raise peak Fed expectations and bond yields. Makes us short term more cautious and defensive focused.

Bonds set for a comeback

Bonds world’s biggest traded asset class. See interest as 1) newly higher yields 2) bond capital gains as inflation falls, 3) return of 60:40 portfolio diversification. See BIL to TLT ETF’s

Lower lithium benefits Tesla but also miners

Soared lithium prices off highs, raising China EV demand fears. Lower prices welcomed by EV makers, like TSLA, but are still high and unlikely to derail miners, like ALB or LTHM.

The airline recovery runway

Starting to recoup $187bn pandemic losses, A strong demand rebound and higher prices are offsetting jet fuel and wage costs.

Crypto weakens on bank fears

Bitcoin (BTC) and crypto assets pulled bank after dramatic rally this year. Driven by Silvergate (SI) bank payment network pressures and broader global interest rate concerns. Litecoin (LTC) resilient ahead of August halving, with Polygon (MATIC) and Polkadot (DOT) lagging. Dubai latest to unveil regulatory framework.

Commodity markets see some relief

Better week as energy prices rebound, and dollar eased. Narrowed its losses this year, but remains the weakest major asset class. US natgas rebounded as recent price plunge cut supply, as LNG and weather demand picks up. China centric industrial metals helped by better PMI and focused on ‘two-sessions’ event.

The week ahead: China, Powell, and jobs

1) China ‘two sessions’ meet with new policy heads and big GDP target. 2) ‘High-for-longer’ Central Bank rates focus as Powell speaks and RBA raises. 3) US jobs report (Fri) slowdown from last 517k blowout. 4) Q4 earnings from JD to ADS and CRWD, plus CERA energy event.

Our key views: A clear but gradual recovery

See gradual recovery with plenty bumps in road. The inflation and interest rate shock is slowly easing, and global recession risks have faded. Short term momentum to ease with sentiment less bad and bond yields higher. Focus cheap and defensive assets. Higher risk crypto, tech, small cap as inflation fall picks up.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.75% | -1.58% | 0.74% |

| SPX500 | 1.90% | -2.20% | 5.37% |

| NASDAQ | 2.58% | -2.65% | 11.68% |

| UK100 | 0.87% | 0.57% | 6.65% |

| GER30 | 2.42% | 0.66% | 11.88% |

| JPN225 | 1.73% | 1.52% | 7.02% |

| HKG50 | 1.73% | 1.52% | 7.02% |

*Data accurate as of 06/03/2023

Market Views

Stocks resilient to rising bond yields

- After falling in February, global stocks resilient to US 10-yr bond yields breaching 4% and Europe’s core inflation rising to 5.6%. As China PMI showed its reopening gathering pace. The dollar eased, commodities firmed, and bitcoin fell. Corporate news saw TSLA’s investor day disappoint, LLY slashed drug prices, and CRM surge on strong results. See our 2023 Year Ahead View HERE.

Two months down and ten to go

- Markets saw a February reality check after wrong footing investors with January’s big rally. Sticky US inflation and firm economies pushed back peak Fed expectations and raised bond yields. Global stocks fell 3%, led by China and rate sensitive real estate. The dollar rallied, bitcoin held onto its big YTD gains, and Europe bucked the pullback.

- This tightening of financial conditions may have more to go with inflation expectations becoming unanchored. This keeps us short term cautious and focused on defensives from healthcare to high dividend yield. But we believe October was the market low and out-of-position investors will buy any meaningful weakness.

Bonds set for a comeback

- Bonds are world’s biggest traded asset class, at c$130 trillion, and one of its most liquid. They fell sharply out of investor favour last year. Many saw the worst ever performance. Hit by the double whammy of the global inflation and interest rate shock. And high valuations after a multi-decade rally. This has opened up opportunities this year.

- Of newly attractive yields vs US savings accounts at only 0.3%. Or for bond capital gains as inflation falls. Or for those seeing a return of the classic 60:40 portfolio diversification. From safer haven BIL’s to longest duration TLT ETF’s.

Lower lithium benefits Tesla but also miners

- Soared lithium prices are now off their highs. This is stoking fears on China’s underlying electric vehicle demand, the biggest market, as it reopens and subsidies are cut. Lithium declines are to be expected as supply is added. They are welcomed by EV makers, but are also unlikely to derail miners.

- Tesla‘s (TSLA) expansion will need more and lower cost lithium to be competitive. Whilst miners like ALB and LTHM are already priced for pain, with their 10x P/E valuations. And with Li2CO3 prices still well above average levels, most volume locked into long term contracts, and EV demand growth and adoption just starting. @BatteryTech.

The airline recovery runway

- Airlines are usually considered some of the riskiest stocks. Virgin Atlantic founder Richard Branson said quickest way to become a millionaire in the airline business is to start a billionaire. But it has changed. Airlines have consolidated and become disciplined. This even attracted Warren Buffett for a while.

- They are now outperforming out of the pandemic. The demand recovery has further to go. Consumers are prioritising travel. Airlines are charging more. This helps everyone from airlines (like JETS), to engine makers (GE, RR.L). @TravelKit.

February asset class performance (%)

Weakens on crypto bank fears

- Crypto assets saw a pullback, after their dramatic gains this year. As Silvergate (SI) bank crypto payment network pressured and in the context of heightened global interest rate concerns.

- Litecoin (LTC) gained ahead of its August halving. With price weakness lead by MATIC and DOT.

- Crypto-focused US bank Silvergate (SI) slumped again, after delaying filing of its annual report and announcing new securities portfolio losses.

- Dubai and its Virtual Asset Regulatory Authority (VARA) became the latest global regulator to unveil its crypto regulatory framework.

Commodity markets see some resilience

- Commodities had a better week, as natgas and oil rebounded, helped by a weaker dollar. But is still weakest asset class this year. Focus remains on slowing global GDP growth and a firmer US dollar. With much hope pinned on the reopening of China, world’s biggest commodity importer.

- US natgas prices rebounded strongly after recent sharp weakness. Producers have responded to lower prices by cutting supply, whilst demand was boosted by a pick up in LNG exports, as the Freeport plant restarted, and colder US weather.

- China-centric industrial metals, from copper to aluminium, will be closely watching China’s ‘two sessions’ meeting and its GDP growth targets.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 2.99% | -2.69% | 12.64% |

| Healthcare | 0.80% | -2.83% | -4.20% |

| C Cyclicals | 1.46% | -3.92% | 13.05% |

| Small Caps | 2.00% | -2.88% | 9.48% |

| Value | 1.08% | -1.97% | 0.77% |

| Bitcoin | -3.80% | -4.12% | 35.12% |

| Ethereum | -3.24% | -5.44% | 30.70% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: China, Powell, and jobs

- China’s ‘two sessions’ big political and legislative meets kicked off with hopes for redoubled effort to boost economic growth after covid reopening, and after local equities giving back some gains.

- As ‘high-for-longer’ rate forecasts sweep world, Fed’s Powell speaks to US Senate (Tue). Australia’s RBA to hike again. Canada’s BoC on hold. Whilst Japan’ dovish BoJ (Fri) to see Kuroda’ last meeting.

- Fridays’ US jobs report the data highlight. Hope for a sharp slowdown to est. 200k new jobs after prior 517,000 shock stoked Fed rate hike fears. It also comes after the JOLTS openings report (Wed).

- Remaining Q4 earnings have global flavour with Asia e-commerce JD.US, TCOM.CH, SE, Europe’s ADS.DE, ZAL.DE, FERG.L, HO.PA, and US’s CRWD, CPB, ULTA, DKS, CASY. CERA energy week runs.

Our key views: A clear but gradual recovery

- See gradual recovery with plenty of bumps in road. The US inflation and interest rate shock is slowly easing, and global recession risks faded with China reopening and plunged natgas. But short term equity market momentum to ease with investor sentiment now less bad and bond yields higher.

- Focus cheap and defensive assets, from high dividend yield, to healthcare, and UK. With higher risk crypto, tech, and small cap assets as the inflation fall accelerates and would de-risk markets. Overseas markets to lead the US. Commodities and the US dollar to take a performance back seat.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 2.62% | 1.16% | -3.98% |

| Brent Oil | 3.80% | 7.74% | 0.01% |

| Gold Spot | 2.46% | -0.80% | 1.78% |

| DXY USD | -0.64% | 1.57% | 0.97% |

| EUR/USD | 0.83% | -1.52% | -0.64% |

| US 10Yr Yld | 0.66% | 43.59% | 7.35% |

| VIX Vol. | -14.67% | 0.87% | -14.67% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point change

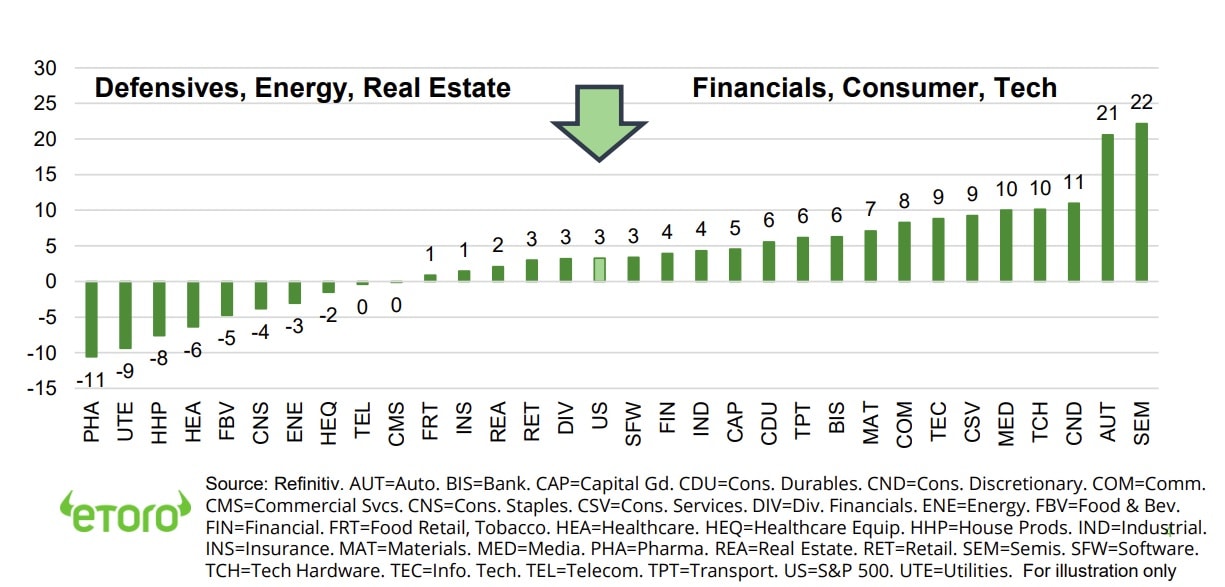

Focus of Week: Time for some sector rotation

More volatile markets argue for some a change of sectors and styles

Sticky US inflation and resilient economies have pushed back peak Fed rate hike expectations and raised bond yields. This tightening of financial conditions may have more to go with inflation expectations becoming unanchored. This keeps us more short term cautious, and focused on traditional defensives, from healthcare to high dividend. These are the underperformers this year, but we think due for a revisit. We still believe October was the market low and out-of-position investors will buy meaningful weakness.

Traditional (and non-traditional) defensives to get a second look as the macro-outlook clouds again

Traditional defensives, from healthcare to staples, been among biggest underperformers this year. This was a sharp turnaround from their 2022 leadership. It has been driven by the tech led ‘reversal rally’. And recent impact of rising bond yields on these ‘long duration’ stocks. See partial return to the 2022 playbook of defensives outperformance in coming months. As investors navigate high-for-longer interest rates and slowly building recession fear. See other traditional, like defence, and non-traditional, like airlines, defence.

Financials are one of the biggest winners of the current macro environment

Bank stocks have modestly outperformed in the US this year and been the top performers in Europe. They are one of the biggest winners of the current macro environment in our view. High-for-longer interest rates support their lending margins. Whilst easing recession worry trims credit quality and loan growth concern. It remains one of the cheapest sectors, with among highest dividends and share buyback yield.

Need to be more discriminating within the outperforming tech sector

The biggest US ‘sector’, at c40% the index overall, led the reversal rally this year. It now faces pressure from rising bond yields. These disproportionately impact those with the highest valuations, like tech. But not all tech stocks are created equal. We can justify the disruptive tech rally, but it’s still high valuations and loss making companies makes it more vulnerable than the wide moats and fortress balance sheets of ‘big tech’.

Real estate most impacted by higher interest rates. Energy see’s cross-currents and no ‘three-peat’

Real estate is seen as a traditional safer haven but is suffering from its sensitivity to higher interest rates as the most indebted sector. And is still adjusting to structural pandemic changes, from high office vacancies to now falling industrial warehouse demand. A high-for-longer Fed is a headwind. Commodities are also lagging under the weight of the strong dollar and after two years of performance leadership. This is balanced by low valuations, huge cash generation, and demand hopes from China’s economic reopening.

S&P 500 Price Index vs Total Return Index (Reinvested Dividends, 20-years)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle and stubborn inflation boosted uncertainty, recession risk, and hit markets. We see this gradually fading in 2023, with global growth stressed but resilient, inflation pressure slowly easing, and valuations now more attractive. Focus on cheap and defensive assets for a gradual ‘U-shaped’ market recovery. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the market rout, and now at average levels, and are supported high company profitability and near peak bond yields. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by defensive growth. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and tech/small cap/crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies are not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices amd reopening China with still high ‘buffers’ of rising fiscal spending (defence and refugees) and still weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by the lack of a big tech sector, and 30% cheaper valuations vs US. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. Broader EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, if global growth resilient and bond yields risen. Japanese equities among worlds cheapest but threatened by tightening monetary policy and stronger Yen with rising inflation and new BoJ governor. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors -discretionary (autos, apparel, restaurants), industrials, energy, materials- are cheap and attractive if see ‘slowdown not recession’ and lower inflation helps consumers. Select but high risk opportunities from energy to financials. With depressed earnings, cheaper valuations, and been out-of-favour for many years. |

| Financials | Benefits from high bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and with room for large dividend and buyback yields. But can be outweighed by high recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) the least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has wide spread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attrative cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+ supply and Russia 10% world oil supply problems. But commodities not to repeat their 2022 performance leadership. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.