SLOWDOWN: Current bank sector concerns are individual not systemic. But lending standards on both sides of the Atlantic have tightened a lot, and this will accelerate now. As banks rein back risk and regulators boost their oversight. This tightening of financial conditions is equal to a significant interest rate hike. It effectively does the Fed’s work by other means. The economy and inflation will slow faster. The Fed’s big rate hiking cycle will end sooner, and cuts start earlier. This turbo charges our 2023 playbook, of rising earnings pressure and valuation relief.

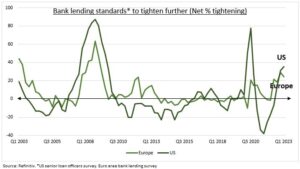

LENDING: The chart shows the percentage of European and US bank loan officers increasing lending standards. This is a clear leading indicator for lending volumes and an economic growth slowdown. Lending conditions are already at the tightest levels outside of a recession in recent history. They are now set to tighten even further. 1) As bank managements seek to protect their liquidity and asset quality. 2) And in anticipation of a coming regulatory crackdown, especially amongst smaller banks. Banks are responsible for 40% of all business financing in the US, and 80% in Europe. Bond markets are responsible for the remainder and are also tightening.

REACTION: Small and mid-size US banks, with under $250 billion assets, will be most hurt by this liquidity hoarding and regulatory crackdown. They are disproportionately important in some areas. They are 60% of mortgage lending, and over 70% of commercial real estate lending, for example. This accelerates our 2023 investment view. A faster GDP and inflation slowdown, and nearer rate cutting cycle. Earnings will suffer more, but valuations see more relief. Focus on defensives and ‘big tech’, and be more cautious on cyclicals, small caps, and commodities.

All data, figures & charts are valid as of 20/03/2023