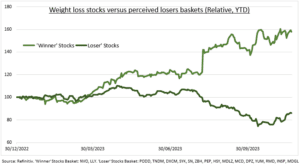

LOSERS: The advent of GLP-1 weight-loss drugs is a boon for the billions of overweight people globally and the two stocks that dominate the industry today. But it’s been a bust for the stock market. With investors selling those across healthcare and consumer staples that seen losing demand. This made these traditional defensive sectors some of the worst performers this year. Our 15-stock GLP-1 ‘loser’ basket underperformed the S&P 500 by 30pp (see chart). We see at least five reasons the earnings fears are overdone, from slow adoption to positive side-effects. The greater risk is of a structural valuation discount as weight loss drug usage inevitably soars.

OFFSETS: Investors sold first and asked questions later. 1) GLP-1 adoption to be huge but gradual. Annualized US cost $16,000; Medicare and insurers don’t cover; 50% weight regained once off, and producers capacity constrained. Overall, this could cut overall calories 1-3% long term. 2) Companies will not stand still. They will adjust offerings, packaging sizes, marketing, and prices. 3) There are offsets. Less obese patients will now be able to have knee surgeries, for example, or drive more demand with the extra exercise. 4) Diabetes and tracking needs may increase. With its chronic nature and the dramatic under-penetration today. 5) Forest for the trees. These traditional defensive sectors are resistant to the current US economic slowdown.

BASKETS: We created a simple-weighted ‘losers’ basket with three stocks from each of the five main segments seen suffering from the adoption of weight-loss drugs. Diabetes (PODD, TNDM, DXCM), Orthopaedics (SYK, SN, ZBH), Medical Devices (RMD, INSP, MDGL), Snacks (PEP, HSY, MDLZ), and Fast Food (MCD, DPZ, YUM). We compared this basket to the performance of NVO and LLY, the two stocks with GLP-1 drugs currently in the market. The ‘losers’ basket has underperformed ‘winners’ by 70pp this year, and lagged broader S&P 500 index by 30pp.

All data, figures & charts are valid as of 23/11/2023.