Risk management is a crucial aspect of investing, and many investors seek tools to protect their portfolios from market volatility. Among these tools, the VIX index, also known as the fear index, holds a prominent position. As a measure of the implied volatility of options on the S&P 500 index, the VIX offers a unique way to hedge against market fluctuations. This article explores the role of the VIX in portfolio hedging and how investors can use it to reduce risks associated with market volatility.

What is the VIX?

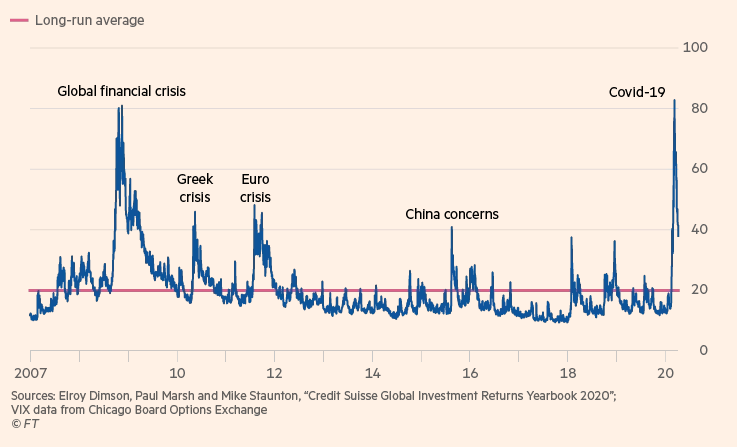

The VIX (Volatility Index), sometimes called the “fear index,” is an index that measures the expected volatility of the US stock market, specifically the S&P 500 index, over a 30-day period. It is calculated using the prices of options on the S&P 500 index and represents implied volatility, that is, the variation anticipated by investors in the market. A high VIX indicates that investors expect high volatility, which can signal increased uncertainty, often linked to macroeconomic or geopolitical events. Conversely, a low VIX reflects a perceived period of stability in the financial markets. Thus, the VIX is a barometer of fear and confidence in the markets.

Why use the VIX to hedge a portfolio?

Investment portfolios are naturally exposed to volatility risks, which can lead to substantial losses, especially during periods of economic or geopolitical uncertainty. The VIX allows investors to protect themselves against this increased volatility and reduce the negative impact of market fluctuations. Here are some reasons why the VIX is a valuable tool in portfolio hedging:

- Hedge against market declines: During periods of high volatility, stocks can experience significant price drops. The VIX, as a measure of volatility, often rises during market declines. Consequently, by holding derivatives based on the VIX, such as futures or options, investors can profit from the rise in the VIX during periods of crisis.

- Protection against unforeseen events: The VIX is particularly useful for protecting against unforeseen events that can trigger sudden and significant volatility in the markets, such as a financial crisis, war, pandemic, or major political decisions. During such events, the market often reacts excessively, leading to a sharp increase in volatility, which is reflected in a rise in the VIX.

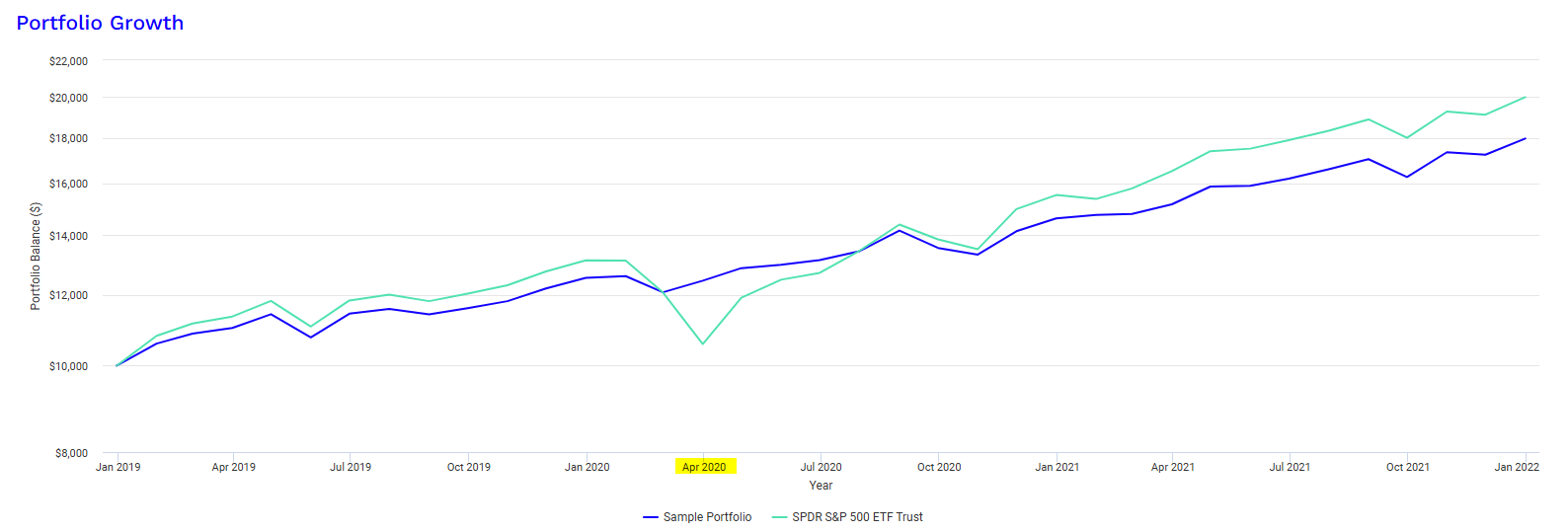

- Reducing exposure to market declines while maintaining upside potential: The VIX can also be used to reduce exposure to declines while maintaining some upside potential. A diversified portfolio that includes stocks, bonds, and other assets can be vulnerable to volatility. Rather than selling stocks or significantly reducing equity positions to limit risk, an investor can buy options on the VIX for hedging.For example, here an allocation with 5% UVXY and 95% SPY avoided a drawdown during the covid crisis in March 2020:

- Volatility of volatility: dynamic risk management: Another important feature of the VIX is that it offers dynamic risk management. Unlike more static hedges, using the VIX allows investors to react quickly to changing market conditions. The VIX is a particularly flexible tool as it can be used based on the expected direction of the market (rising or falling volatility) and the desired intensity of the hedge.

How to use the VIX to hedge a portfolio?

There are several ways for investors to use the VIX in hedging their portfolios. The main methods include:

- VIX futures contractsOn Etoro you have access on two VIX future contracts front months:

- VIX options

- VIX-based ETFs and ETNs

Here are some ETFs and ETNs on Vix that you can find on Etoro:

Limitations and Risks of Using the VIX

The Risks Associated with Using VIX Futures and ETNs: The Rolling Cost

The VIX index, often dubbed the “fear index,” measures the implied volatility of options on the S&P 500 index over a 30-day period. While it’s a valuable tool for hedging against market fluctuations, using VIX futures and exchange-traded notes (ETNs) carries significant risks. One major risk is the rolling cost, a phenomenon that can negatively impact long-term returns.

- Understanding Rolling Cost Rolling cost is a characteristic of futures contracts, which are financial contracts that allow investors to bet on the future direction of an asset’s price (in this case, volatility). VIX futures are often used to hedge against rising volatility or to speculate on market direction. However, these contracts have a limited duration and expire after a certain period, typically 30 days. To maintain a long-term position in futures, investors must “roll” their contracts. This involves selling expiring futures contracts and buying contracts with a later expiration date. Rolling cost occurs when short-term futures contracts (those expiring soon) are cheaper than longer-term futures contracts (those with a more distant expiration). When an investor buys a more expensive futures contract to replace an expiring one, they incur a loss due to the price difference. This phenomenon is amplified in a market state known as contango, where longer-term futures contracts are consistently more expensive than shorter-term ones. Rolling cost then becomes a negative factor for the long-term returns of futures and ETNs.Let’s take an example to illustrate the cost of roll over on VIX futures:

- Let’s assume that the future short-term VIX is trading at 14.2 and the future long-term VIX is trading at 15.9.

- If an investor holds the futures contract expiring in December and wants to continue holding a position, he will have to sell his contract expiring at 14.2 and buy a long-term contract at 15.9.

- This creates an immediate loss of 1.7 points for the investor, simply due to the price difference between the short-term and long-term contracts.

This phenomenon can have a substantial impact on long-term returns, especially in a market where volatility is low, but long-term futures prices remain high due to persistent contango.

- Rolling Cost in VIX Futures VIX futures are derivative instruments that allow investors to speculate on future market volatility or hedge against increased volatility. As mentioned earlier, these contracts have fixed expiration dates, and to maintain an open position, investors must roll their contracts.

- Rolling Cost in VIX ETNs Exchange-Traded Notes (ETNs) linked to the VIX, such as the VXX or UVXY, are financial products that allow investors to gain exposure to volatility without directly dealing with futures contracts. These ETNs are often used by investors to gain exposure to the VIX in a simpler way. However, these products are also affected by rolling costs. ETNs typically invest in VIX futures contracts, and when they roll these contracts, they encounter the same contango problem as futures. As a result, ETNs can suffer from a long-term downward bias, as they must buy more expensive futures contracts as the old ones expire. This can lead to a gradual decline in the value of the ETNs, even if market volatility remains high or the VIX increases.

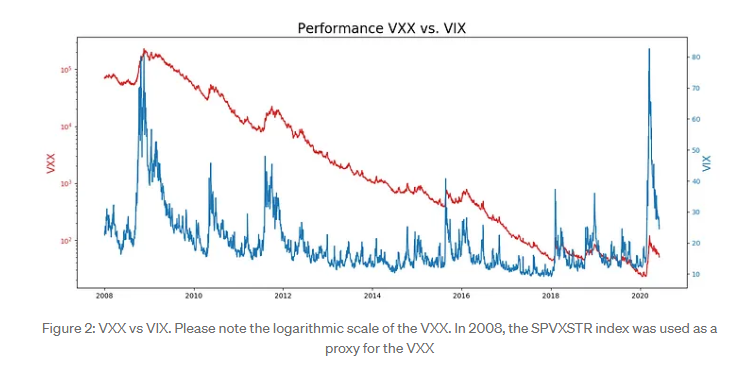

Illustration: Impact of Rolling Cost on the VXX

Consider the VXX, a popular ETN that tracks VIX futures contracts. The chart below illustrates the impact of rolling cost on this product. We compare the evolution of the VXX with that of the VIX spot (the actual value of the VIX).

As shown in the chart, the VXX doesn’t perfectly track the VIX spot. Due to rolling costs, the VXX exhibits a downward trend over the long term, even when volatility increases. This phenomenon is caused by contango, which drives up the prices of longer-term futures contracts, leading to constant losses for long-term investors.

As shown in the chart, the VXX doesn’t perfectly track the VIX spot. Due to rolling costs, the VXX exhibits a downward trend over the long term, even when volatility increases. This phenomenon is caused by contango, which drives up the prices of longer-term futures contracts, leading to constant losses for long-term investors.

- The Effects of Rolling Cost on Long-Term Returns The effects of rolling costs can be particularly pronounced over extended periods. For example, if an investor buys VIX futures or a VIX ETN like the VXX and holds the position for several months or years, they will incur continuous losses due to rolling costs, even if market volatility remains relatively stable. The impact of rolling costs is especially noticeable during periods of low volatility but high futures prices due to contango. Even if volatility increases temporarily, the effect of the price difference between short-term and long-term contracts can outweigh the gains realized by the investor. This phenomenon is often referred to as the “decay” of VIX-based ETNs.

Conclusion

The VIX is a valuable hedging tool for investors seeking to protect themselves against market volatility. As a barometer of fear and uncertainty in the financial markets, the VIX allows investors to hedge against market declines and unforeseen events while maintaining potential upside. However, it’s essential to use the VIX with caution and understand the risks associated with its use, particularly in leveraged derivative products. By incorporating the VIX into a hedging strategy, investors can better manage volatility and protect their portfolios from significant losses.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.