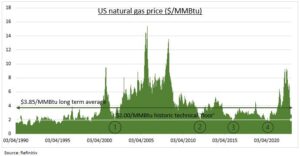

GAS: Natural gas prices on both sides of the Atlantic have continued to plunge. This has been a key macro positive, driving lower inflation and stronger economic activity forecasts. But painful for commodity investors, with US prices near half long-term averages and approaching historic $2/MMBtu price ‘trough’. The difference now is that US supply has not responded to the low prices. European natgas prices have also plunged, but remain well-above average, and should see support from rising Asian LNG competition and need to refill storage levels for next winter.

USA: US prices are near half long-term average levels and approaching levels only seen – briefly – four times before in the past 25 years (see chart). The US has seen one of the three warmest starts to the year going back to 1895. This drove consumption lower than last year and left inventories 23% above average. The US EIA forecasts a 2023 price recovery, to an average $3/MMBtu, driven by double digit increases in LNG demand and seasonal electricity demand. But a difference vs prior price lows is the supply response has been slow. US natgas drill rigs are up 18% vs last year, whereas the last two price troughs saw rig falls of 60-80% from peaks.

EUROPE: Warm weather, industrial and consumer demand ‘rationing’, and now above average storage levels, have combined to drive dramatic TTF natural gas price falls. But this price fall has its limits. Europe’s focus is starting to switch from the winter heating season towards the storage rebuild needed for next winter. This faces the risk of a total Russia supply shutdown and increasing LNG competition from a reopening China. Asia LNG demand is typically more than double Europe’s. The continent’s exposure to the spot LNG market has increased dramatically from 20% to 50% in the past two years. Etoro has now added European natgas to the platform.

All data, figures & charts are valid as of 29/03/2023