RISK: Brent oil prices hit $90/bbl. for the first time this year as top OPEC+ producers, Russia and Saudi Arabia, extended their supply cuts until year end. This comes against a backdrop of resilient oil demand, and with biggest buyer China now drip-feeding policy stimulus and the US rebuilding its strategic reserve. Higher oil prices are a short-term double-threat to markets, as a $100 billion US consumer tax and already pushing up inflation expectations. This is a recipe for short term market volatility, but we see it as ultimately self-correcting. As further oil price rises trigger inflation, interest rate and growth slowdown fears. US gasoline prices are 23% off lows, with impacts exacerbated by the US’s low gas taxes, relative car inefficiency, and huge mileage.

IMPACT: Rising gasoline prices act as a tax on consumption, the bulwark of the US economy. The rise from the Dec. 2022 low is equal to a $100 billion annualised consumer drag, equivalent to four times Macy’s (M) revenues. It is also correlated with consumer inflation expectations, a key Fed concern as it considers its next interest rate move. The University of Michigan survey of 1-year expectations has risen for the past three months alongside gas prices, to a latest 3.5%.

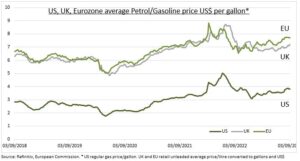

DIFFERENCES: Gasoline prices are a big political issue, with high US gas usage, and high European taxes. US cars have a below global average fuel efficiency (-20%) but travel twice as far (14,000km) per year. UK and EU efficiency is better (+15% over average) and they travel less (under 7,000km), but fuel taxes are high (see chart). 50% of UK and 60% EU pump prices are tax (fuel duty and VAT). This is triple US, where the $18.4c/g Federal gas tax is unchanged since 1993. IMF estimates the world spends $7 trillion on fossil fuel subsidies, undercharging for environmental costs and forgone consumption tax. $500 billion of this ‘subsidy’ is from the US.

All data, figures & charts are valid as of 05/09/2023.