OUTLOOK: We expect the markets fever to break in October. As multiple macro ‘wall of worry’ pressures start to ease and seasonality turns positive. Investors had a miserable summer. But we see the vice of higher oil prices and bond yields easing as the US slows in Q4. This may be helped along by the UAW strike, seemingly inevitable government shutdown, and student payments restart. The US economy has the ‘exceptionalism’ momentum to take this, and it should be a relief to hard-pressed investors. Q3 earnings season will likely be a positive catalyst, with the end of the profits ‘recession’, and the market gets a break from the Fed until November.

SEPTEMBER: Saw a building ‘wall of worry’ with $90/bbl.+ oil a consumer ‘tax’ and inflation worry. US 10-yr bond yields spiking to 4.5% pressuring rerated valuations hard. The escalating UAW auto strike hit a quarter US manufacturing. A Federal shutdown threatening a quarter the economy, and 28 million to restart student loan repayments. Plus, investors dealt with the year’s worst seasonality. The S&P 500 lost 5% and VIX volatility surged a third. The dollar rose to a nine-month high as the ‘safer haven’, whilst Bitcoin sat it all out. IPO markets reopened, from ARM to CART, and weight-loss NVO overhauled luxury LVMH as Europe’s biggest stock.

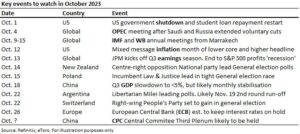

OCTOBER: Focus on US growth headwinds from a government shutdown, strikes, and student loan repayments. A heavy global election calendar, from Poland to Argentina, that leans populist and to the right. The start of a pivotal Q3 earnings season that likely heralds the end of the recent profit’s ‘recession’, with only commodities and healthcare earnings falling. Earnings need to take over the heavy lifting from valuations in driving the market. The Fed is off duty until November 1st, with futures pointing strongly to a further rate hike pause, as the coming inflation report gives another mixed message. Global historic stock seasonality flips positive from -1.1% to +0.9%.

All data, figures & charts are valid as of 28/09/2023.