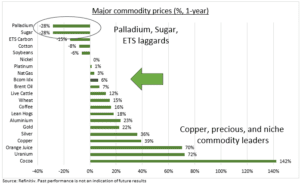

COMMODITIES: The stealth commodity rally is accelerating as developed market interest rate cuts near, the US dollar eases, and Chinese economy stabilises. The recent rally has been across the board from industrial metals to natural gas and cereals. With oil the notable outlier. Sugar and palladium prices have also been left behind, down 30% the past year (see chart). Sugar is oversupplied but low prices stimulating more consumption. Whilst palladium faces slow-moving irrelevance as the carbon transition builds, but platinum’s recent rally eases the substitute competition. For now, this is a rare cost relief for food and beverage and auto stocks.

SUGAR: Prices are at a six year low as the world’s main food and beverage sweetener is in a supply glut. Largest exporter Brazil is set for its second largest ever harvest. Even as no.2 producer India restricts exports. But on the demand side there are signs the 2nd largest importer China is ramping up purchases to take advantage of the low prices. Whilst Brazil has increased its biofuel mandate, to 14% as of March. Sugar is a large (190 million ton) but low value ($370/ton) market. 80% is derived from sugar cane versus colder-weather sugar beat. With major sugar and sweetener stocks from Suedzucker (SZU.DE) to Tate & Lyle (TATE.L).

PALLADIUM: The key ingredient for internal combustion engine (ICE) catalytic converters is under pressure. As palladium-free EV’s have grown from 11% to 14% of all car production in the past year. The recent slowdown in EV adoption has helped palladium track sideways for the past six months, but not move higher. Alongside concerns over dominant South Africa supply outlook. Some relief may come from rallying Platinum, a key substitute. Both are oxygenation catalysts in converters. Turning 90% of engine pollutants into CO2 or water. Big producers are Russia’ Norilsk (MNODL.L), South Africa’ Sibanye (SBSW) and Anglo’s (AAL.L) coming spin-off.

All data, figures & charts are valid as of 15/04/2024.