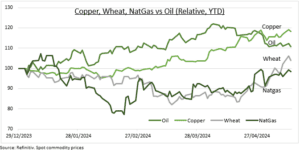

RALLY: The commodity comeback is broadening. With depressed heavyweights from natural gas to wheat now following ‘Dr. Copper’s’ strong lead higher. These big three of energy, ag, and industrial metals are up 20% just the past month. And been validated by the pickup in shipping rates. Weaker oil has obscured this widening rally, holding back the asset class (DJP), given its idiosyncratic geopolitical and OPEC drivers. The underlying rally likely has legs. With the global economy looking up, weather supply-disruption to continue, and low prices curbed supply additions. The outlook for modest US dollar weakness ahead could add further fuel to the fire.

NATGAS: US natural gas prices have rebounded from the lowest levels in 25 years to above the key $2.00/MMBtu level. As major producers like EQT (EQT) and Chesapeake (CHK) have reigned in supply. In response to low natgas prices and have prioritized pumping higher-priced oil. Whilst the summer aircon ‘cooling season’ may revert the abnormal weather headwinds of recent months. And LNG export capacity growth comes into focus. All offsetting the increasing renewables weight in the US generation mix. Overall the US Energy Information Agency see’s natgas prices averaging a cycle low $2.10/MMBtu this year before a stronger recovery next.

WHEAT: Prices have rebounded off four-year lows as the global supply glut is seen easing with near-term production from Brazil to Argentina and Russia all hit by disruptions.Other grains from corn to soybean prices have also risen to a lesser extent. With floods in southern Brazil to frosts in Russia, the world’s largest wheat exporter, and disease hitting Argentina’s corn crop. Whilst the recent El Niño fades but may now be replaced by an opposite La Niña as early as this summer. Rekindling investor memories of the record-breaking La Niña from 2020 to 2023. It typically brings drier weather to Brazil and Argentina and wetter conditions to Asia and Australia.

All data, figures & charts are valid as of 15/05/2024.