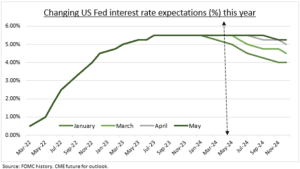

PILLAR: Fed chair Powell kept the door open to US interest rate cuts this year. Less, and later, but still coming (see chart). And this is a key second pillar, alongside stronger earnings, to our thesis that we are in the early innings of a new bull market. But it’s not all positive. It makes markets ever more data dependent, and potentially more volatile. With the near-term focus on today’s jobs report and May 15th’s inflation. Whilst markets may under-price the tail risk that rate hikes still come. But we think the interest rate reset ‘expectations shock’ cools. As lagged US shelter, healthcare, and insurance inflation eases and the tech-led productivity boom continues.

INTEREST RATES: Jay Powell threaded the needle between stickier inflation and the markets 1-cut expectations this year. Alongside the now outdated Fed ‘dot plot’ three cuts and tail risks of a further hike. This makes markets more data dependent. with immediate focus on today’s jobs report. And hope for a return to the c. 200,000 ‘goldilocks’ run rate after a string of upside surprises. Similarly, April US inflation ‘the most important number in markets’ on the 15th having been stuck in a 3% range for ten months. Interest rate futures under-price even the remote tail risk of a rate hike. Even as traditional inflation-hedges like commodities have been perking up.

QUANTITATIVE TIGHTENING: In a triple-positive the Fed announced a slowdown of its quantitative tightening policy from its still-massive $7.4 trillion balance sheet. Treasury’s will now runoff at a $25 billion monthly rate versus the prior $60 billion. This will 1) take incremental pressure off the long-suffering bond market and ‘fair value’ equity valuations. 2) Is reassuringly consistent with coming interest rate cuts, as the Fed tries to keep its two big policy levers consistently aligned. They wouldn’t move in this tapering direction if a rate hike was potentially on the cards. 3) This policy gradualism lessens the chance of the turbulence we saw in 2018.

All data, figures & charts are valid as of 02/05/2024.