SUPPLY: Chile’s plans to nationalize its huge lithium industry surprised markets. It maybe shouldn’t have. This so-called ‘resource nationalism’, of increased country control of its natural resources, is not new. Tougher tax and other rules on foreign owned resource projects are one ingredient for high-for-longer metals prices. And more mining investment flows to Australia, Canada, and US. Metals prices have been hurt this year by the weaker global GDP outlook that has offset the reopening of China. But the structurally tight metals market supply side is a offset. Where resource nationalism combines with the last decade of under-investment when prices were low. Alongside lower ore grades, ESG needs, and investor demands for profit over growth.

CHILE: It is the world’s 2nd largest lithium (30%) and largest copper (27%) producer today. Its lithium nationalization plans will take time to pass and implement but have put big producers from SQM (SQM) to Albemarle (ALB) on notice. Chile nationalized Codelco, the world’s largest copper producer, in the 1970’s. At the same time that the Middle East and Venezuela took control of their own oil reserves. Much more recently we’ve also seen Mexico nationalize its lithium reserves, Indonesia tighten control of its nickel industry and India of its sugar exports. Mining giant Rio Tinto (RIO) was forced to renegotiate its Oyu Tolgoi Mongolia copper project, Freeport (FCX) its Grasberg mine in Indonesia, and Barrick Gold (ABX) its Tanzania assets.

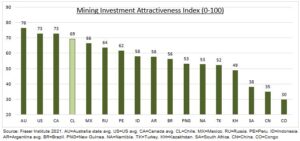

RANKING: Canada’s Fraser Institute polls global miners annually on the investment attraction of countries (see chart). Ranking them by their tax, legal, and political situations as well as their mineral potential. This overall mix is critical to the multi-billion and multi-decade nature of the industries investments. Chile’s rank fell from 6th to 31st the past four years, per the latest report. Western Australia came top of all the 84 country and state jurisdictions ranked globally. This is followed by Saskatchewan in Canada, and by Nevada, Alaska, and Arizona in the US.

All data, figures & charts are valid as of 24/04/2023