SHOPPING: Consumers have been the key to the economic resilience of the US. With labour markets strong, falling inflation, resilient housing and stock market prices, and not all pandemic savings yet spent. But they are spending differently, with a shift back to physical sales from online, and to services from goods. This is a double-challenge to next week’s ‘Prime Day’ that is one of the biggest shopping days of the year. Strength would calm consumer spending fears and support Amazon’ (AMZN) 55% rally this year. Overall forecasts are for 4-6% US retail sales growth this year, down from last’s 7% but above long term average 3.6%. See @ShoppingCart.

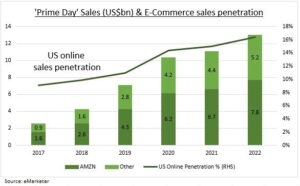

PRIME DAY: On July 11-12 Amazon offers deals to its 200 million+ members including est. 60% of the US adult population. They pay around US$15/month in 22 countries, for free shipping, deals, and entertainment. Amazon’s online store and subscriptions makeup half its revenues. The day also sees others like Walmart (WMT) and Target (TGT) piggy-backing on the event and offering similar deals. Amazon sales are forecast at over $8.0 billion, with another $6.0 from others. It stands with Black Friday (Nov. 24) and Cyber Monday (Nov. 27) as the biggest retail day of the year. It’s a test for the continued rising penetration of online sales, consumer sentiment, and demand for the consumer electronics and apparel that are the biggest sellers.

CHINA: Prime Day is dwarfed by China’s annual November 11th ‘singles day’. Total spending was estimated at $140 billion last year across all major e-commerce platforms, including leaders Alibaba (BABA) and JD.COM (JD). This was ten times the size of Prime Day. China is over half of all global online sales, more than double US. Over half of all Chinese retail sales are online.

All data, figures & charts are valid as of 06/07/2023.