OUTLOOK: Summer’s stock market ‘breather’ turned into a deeper October ‘correction’ but we see grounds for contrarian optimism ahead. Markets are squeezed between soaring bond yields and high oil prices. Both stock and bond prices fell last month, with Bitcoin the surprise safer haven. The November focus is the heavy political calendar, end of a positive earnings season, and start of Christmas’ consumer test. We look for the bond yield and oil vice to stabilise and start to ease, giving relief to hard pressed markets. Allowing a refocus on firming earnings, returning central bank ‘puts’, and the strong technicals of poor sentiment and better seasonality.

OCTOBER: Stocks fell back into a ‘correction’, down over 10% from the July highs. US 10-year bond yields hit 5% and Brent oil prices rose to over $90/bbl. Geopolitical concerns spiked after Hamas’s attack on Israel. Haven gold regained $2,000/oz but ‘digital gold’ Bitcoin stole the show rebounding to $35,000, extending its asset class leading gains this year. Q3 company results saw tech drive an end to the nine-month S&P 500 earnings recession. TSLA fell 20% on lower EV prices and demand fears, and the six-week UAW strike ended. XOM and CVX dramatically drove M&A with $115 billion of deals. WMT starts to see a spending impact of weight loss drugs.

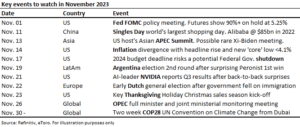

NOVEMBER: The political agenda is busy, from Middle East, to rare Xi-Biden meeting, potential US government shutdown, and Dutch and Argentine voters going to polls. NVDA (21st) will provide the Q3 earnings season finale, after AAPL (2nd) and WMT (16th). The resilient consumer is in the spotlight as BABA and 0700.HK unite for first time for China’s huge Singles Day and Thanksgiving kicks off Christmas spending season. The UN’s COP 28 climate conference starts with renewables stocks some of the year’s worst performers and ‘big oil’ doubling down on fossil fuels. November is typically the 3rd best month globally for stocks, with a 1.2% average rise.

All data, figures & charts are valid as of 31/10/2023.