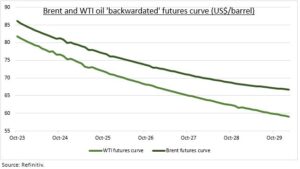

OUTLOOK: Oil prices may have now re-set to a new and higher range. With OPEC+ cutting supply significantly and global demand stronger than feared. These are great prices for most oil stocks (XLE), well above cash flow break-evens, and as wide refining crack spreads further boost prices for many. But the going will likely be tougher from here. Higher oil prices may ‘self-correct’ as they trigger global macro-driven demand slowdown fears. Whilst higher prices will also strongly test OPEC’s supply cutting resolve. Balancing this, forward curves are in steep backwardation, reflecting views of sharply lower prices ahead, but also counter-intuitively helping prices today. Whilst global inventories are low. The world is watching, as higher prices would undermine the goldilocks outlook for lower inflation and interest rates. @OilWorldWide.

SUPPLY/DEMAND: China’s struggling economic outlook is the demand focus. It’s ‘only’ 15% of global oil demand but 70% of the incremental 2.3mbpd of growth this year. This is seen cooling next year as global growth flatlines and energy transition efficiency standards and EV growth bite more. The US special petroleum reserve flipping from seller to buyer will be a small demand support. OPEC is 28% of global oil supply and cut output c.1mpd from end 2022 levels, taking production to a 2-yr low. The US drove 80% global production gains this year but rig counts are now 15% from recent highs. Inventories are below average, with refined products especially low.

BACKWARDATION: Futures show investors see lower prices (see chart). This ‘backwardation’ can be counter-intuitively positive. 1) High prices today encourage selling of inventories, supporting future prices. 2) Incentivizes production today rather than investing in future production. 3) Allow traders to buy more oil for same cost by rolling to lower price contracts.

All data, figures & charts are valid as of 15/08/2023.