LONG HAUL: The China and HK stock rally has come off the boil. This is unsurprising after the dramatic c.60% October-January reopening rally, with local stocks now the ‘most crowded’ in BAML’s institutional investor survey. But we see this as an investing marathon not a sprint, after multi-year underperformance. Valuations are still low. The economic rebound just starting. And March’ ‘two sessions’’ event a catalyst. This will likely show a redoubled government effort to accelerate the economy and support the huge property sector. This has global impacts, from Germany to Australia, and the luxury to commodity sectors. See @ChinaTech and @ChinaCar.

TWO SESSIONS: The top political advisory body, the Chinese People’s Political Consultative Conference (CPPCC), starts its annual session March 4th in Beijing. Whilst the legislature, the National People’s Congress (NPC), starts March 5th. This so-called ‘two sessions’ will confirm Xi Jinping’s third term as President, as well as appoint the Premier and other cabinet members. It will also review the government work report, approve the budget, and pass legislation.

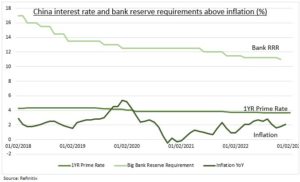

FORECASTS: The ‘two sessions’ is likely to set a GDP growth target of over 5%. This would be up significantly from the actual 3% growth last year that was well under target. This would make it potentially the only major economy to grow more this year than last. It will likely come alongside an unchanged 3% inflation target. This would allow for more stimulus from lower reserve requirements (RRR) and the current 3.65% policy rate (see chart). But this is not 2008. Stimulus will be smaller, and consumer led. Commodities will be helped but not lead this time.

All data, figures & charts are valid as of 21/02/2023