Summary

Performance vs earnings disconnect

Earnings have been resilient so-far and are in the spotlight as recession risks build. Q1 set to again be ‘less bad’ and a market relief. Expectations are low, GDP still decent, and overseas improving. But is a disconnect with price performance as cyclicals to lead Q1 growth, whilst defensives and tech lag. Banks kick off (Fri) and are in spotlight after spate of failures. But regional banks are small. Europe to do better again, with stronger growth and wider profit margins.

Recession fears return to markets

Recession fear returned at Q2 start after string of weaker US data, from PMI’s to jobs. Dollar fell as investors now see 0.75% of Fed cuts by year-end. Defensive stocks led, Gold rallied to over $2,000, and 10yr yields fell under 3.3%. Q1 earnings start Friday. GLEN offer $22bn for TECK. DIS streaming chief fired. WMT automating stores. VORB went bankrupt. See 2023 Year Ahead HERE. Video updates, twitter @laidler_ben.

Navigating the growth slowdown

US economy to slow faster, worrying investors, hurting cyclicals from small cap to commodities, but a silver lining of lower inflation and interest rates helping long duration assets.

Commercial real estate not as bad as looks

Commercial real estate seen as next macro shoe to-drop but 1) 10yr loans with low loan-to-values, 2) problems well known, 3) interest rates to fall. Is not systemic. @RealEstateTrusts

Euro beyond 1.10 may be hard won

Euro rallied as interest rate differential moved fast in its favour. But not immune to growth risks and Fed cuts now well-priced. EUR by far biggest weight in DXY US Dollar Index.

The Easter sugar high

Our Easter eggs cost index is up. Sugar and cocoa among best commodity performers YTD. The problem of surging food costs.

Bitcoin holds on to dramatic YTD gains

Bitcoin (BTC) resilient to broad market volatility, with only XRP (XRP) giving back some of gains. Meme-coin DOGE up on Twitter (TWTR) payment hopes. MicroStrategy (MSTR), the top corporate BTC holder, added to hoard. March NFT trading near record $1.95bn. Long awaited ETH Shanghai upgrade happens on Wednesday.

Gold rises over $2,000 on safe-haven demand

Commodities higher after OPEC+ surprise supply cut took Brent to $85/bbl. Gold rose to $2,000/oz. with a near perfect backdrop of a weaker dollar, lower US bonds yields, and safer-haven demand. Whilst industrials metals, from ‘Dr. Copper’ to zinc, fell back on recession worries. GLEN bid $22bn for copper/coal peer TECK.

The week ahead: Inflation, earnings, IMF

1) US inflation (Wed) set for 9th fall to under 6%. Also see the last FOMC meeting minutes as Fed readies to halt hikes. 2) JPM kicks off Q1 earnings season (Fri). S&P 500 ests. -6% YoY. 3) IMF/World Bank spring meeting and latest macro outlook. 4) UK March GDP and US retail sales.

Our key views: Accelerated macro outlook

Banking fears individual not systemic. But doing Fed’s job for it. Accelerating GDP and inflation slowdown and interest rate peak. See market recovery with bumps in road. Slowdown hurts earnings. Less yields help valuation. Focus cheap and defensive assets, from healthcare to big tech More cautious on cyclicals and banks.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.91% | 3.81% | 1.02% |

| SPX500 | 1.34% | 4.76% | 6.92% |

| NASDAQ | 0.62% | 6.61% | 15.49% |

| UK100 | 1.59% | -1.76% | 3.89% |

| GER30 | 0.49% | -0.23% | 12.02% |

| JPN225 | -1.87% | -2.22% | 5.46% |

| HKG50 | 0.69% | 1.40% | 2.78% |

*Data accurate as of 10/04/2023

Market Views

Recession fears return to markets

- Recession fear returned at Q2 start after string of weaker US data, from PMI’s to jobs. Dollar fell as investors now see 0.75% of Fed cuts by year-end. Defensive stocks led, Gold rallied over $2,000, and 10yr yields fell under 3.3%. Q1 earnings start Friday. GLEN offer $22bn for TECK. DIS streaming chief fired. WMT automating stores. VORB went bankrupt. See our 2023 Year Ahead HERE.

Navigating the growth slowdown

- Recession fears returned to markets after a string of weaker US data. From ISM reports to jobs data. Alongside OPEC’s aggressive pre-emptive move to cut production in response to the coming growth slowdown. This was a particular drag for growth sensitive assets from small caps to industrials.

- This is in line with our Q2 outlook for an accelerated growth slowdown. The silver lining is this leads to a faster inflation decline, and sooner rate cuts. Our U-shaped recovery view is now a V. Long-duration assets, most sensitive to inflation, are likely relative beneficiaries. From bonds to defensive stocks and big tech.

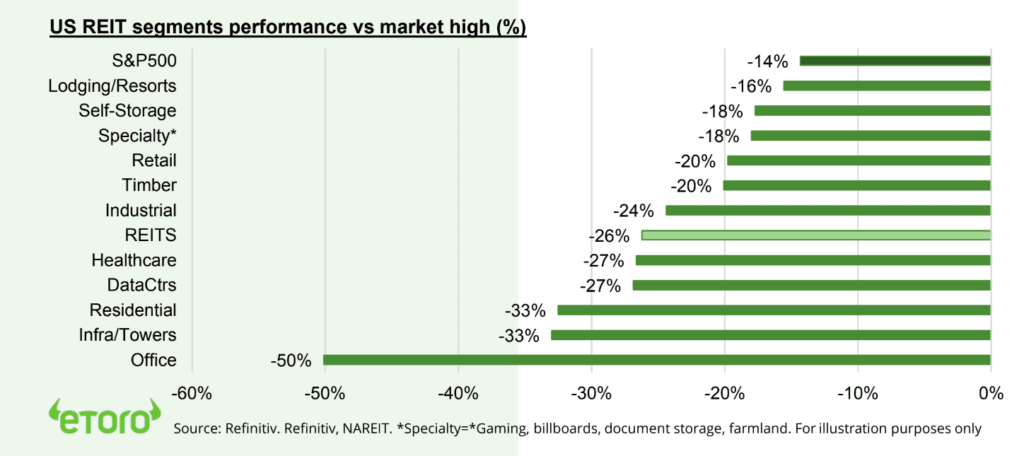

Commercial real estate not as bad as looks

- Commercial real estate (CRE) is being fingered as the next economic shoe to drop, after the recent US banking scare. It’s a $20 trillion asset class in the US alone, and small and mid sized banks are its biggest lenders. These are now in retreat with big twin funding and regulatory headwinds. Concerns focus on offices (from ARE to BXP) as work-from-home keeps occupancy at 50%.

- a manageable and slow moving earnings issue. Not a systemic threat. Lending standards and loan provisioning are conservative, much priced in by public markets (see chart below), and interest rate cuts are coming. @RealEstateTrusts.

Euro beyond 1.10 may be hard won

- Six months is a long time in FX markets. EUR/USD slumped below parity in mid-2022 and troughed at 0.95 in Q3. Recession risks were spiking and the US interest rate differential hit 2%. Rally since driven by ECB’s more hawkish stance, as growth risk faded and inflation sticky, and few bank contagion signs. GBP helped by similar, if less dramatic, trends.

- This came as the Fed neared the end of its interest rate upcycle, the market priced rate cuts soon, and the US dollar’s ‘safer haven’ bid faded. But EUR gains may be harder won from here, with the continent not immune to rising global growth fears and coming Fed cuts now well priced.

The Easter sugar high

- Our index of commodities to make (cocoa, sugar, milk) and package (aluminium, wood pulp) Easter eggs been on rise, led by world-leading cocoa and sugar surges. Even as commodities been weakest of all assets. Will keep pressure on consumer prices and indicative of food supply chain pressures. Has impacts from Ingredion (INGR) to Hershey (HSY).

- This is not welcome. With food inflation rising 9.5% in US and 18% in UK, well ahead of headline inflation, and difficult for policymakers.

US REIT segments performance vs market high (%)

Bitcoin holds onto recent gains

- Crypto held on to recent strong gains, even as capital markets were volatile. Bitcoin (BTC) held at $28,000, but XRP (XRP) gave back some gains.

- Meme-coin DOGE (DOGE) the best performer on hope Elon Musk to use as Twitter (TWTR) option as he replaced its bird logo with a Shiba Inu dog.

- MicroStrategy (MSTR) said bought 1,045 Bitcoin, taking total to 140,000. Cemented its position as the world’s largest corporate holder of the asset.

- Big ETH Shanghai upgrade set for April 12th. NFT March trading volumes near record $1.95bn.

Gold surges over $2,000 on triple benefit

- Oil prices led commodities higher. Brent crude touched $85/bbl. after OPEC+ surprise supply cut boost to 3mmbd, equal to 3% global supply and comes as oil demand fears, risen sharply.

- Gold rose to $2,000/oz., its highest since August 2020. Benefitting from near-perfect backdrop of 1) a weaker US dollar, 2) lower US bond yields, and 3) more demand for safer-haven assets.

- Industrial metals, from ‘Dr. Copper’ to zinc, nickel, and iron ore, fell as a string of weaker than expected US macro data boosted recession fears. This offset surprisingly strong China services PMI.

- Glencore (GLEN) proposed a big $23 billion merger, and coal business split, with Teck (TECK).

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -0.69% | 7.48% | 20.13% |

| Healthcare | 2.85% | 4.67% | -1.55% |

| C Cyclicals | -2.79% | 0.55% | 11.44% |

| Small Caps | -2.66% | -6.61% | -0.39% |

| Value | 0.25% | -0.41% | -1.48% |

| Bitcoin | -1.32% | 26.81% | 69.41% |

| Ethereum | 2.58% | 20.79% | 56.53% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Inflation, earnings kick-off, IMF

- We see US inflation as most important number in markets. See a 9th straight headline fall, below 6%, on Wednesday. Would add to calls for Fed to halt its rate hikes. Also see the latest FOMC minutes.

- Friday Q1 global earnings season start. Forecasts for a 6% fall in S&P 500 earnings vs last year. US bank giants JPM, C, WFC lead off with special focus on impacts from March sector ‘scare’ on business.

- 2023 spring meetings of the IMF and World Bank, April 10-16, in Washington DC bring together global policymakers. IMF world economic outlook and financial stability reports released (Tue).

- UK GDP for March, likely shows economy dodging recession. US retail sales as consumers resilient. Wednesday’ big Ethereum Shanghai fork upgrade (Wed) allows validators to withdraw staked coins.

Our key views: An accelerated macro outlook

- Banking sector fears are likely individual not systemic. Bank buffers are bigger now and the authorities response stronger. But this is doing the Fed’s job for it. By accelerating the GDP and inflation slowdown and the interest rate peak.

- See a V-shaped market recovery with plenty bumps in road. Faster slowdown hurts earnings. But lower bond yields helps valuation. Focus on cheaper and more recession defensive assets, from healthcare to derated big tech. More cautious on assets most exposed to recession risk, like cyclicals, small caps, and commodities. Or lower yields, like banks.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 0.69% | 1.61% | -1.73% |

| Brent Oil | 6.27% | 2.78% | -1.22% |

| Gold Spot | 1.85% | 8.06% | 10.58% |

| DXY USD | -0.40% | -2.37% | -1.38% |

| EUR/USD | 0.60% | 2.50% | 1.92% |

| US 10Yr Yld | -6.67% | -30.07% | -47.48% |

| VIX Vol. | -3.26% | -18.62% | -15.09% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point

Focus of Week: The next big earnings test

Earnings have been resilient and are in the spotlight as recession risks build

Company profits are in focus, after valuations sank last year. Seen as especially vulnerable as recession risks rise. But have stayed resilient so far. Q4 was not as bad as feared, whilst S&P 500 12-mth expectations are unchanged at 4% growth. This is the challenge for Q1. Expectations are low, with estimates cut more than average, high levels of negative guidance, and a big 6% fall vs last quarter. This sets up for another ‘less bad’ quarter, with focus on management’s guidance into the murky macro-outlook. We see continued earnings declines being balanced by valuation relief, and focus on traditional defensives and big tech.

Q1 ‘less bad’ again and relief, with expectations low, GDP decent, and overseas improving

JP Morgan (JPM) kicks off global Q1 earnings season Friday. Consensus for S&P 500 earnings to fall 5%, with revenues up 1%. This implies another profit margin fall to a still high 11.2%. This would be a little worse than last quarter 3% profits fall. Earnings expectations are low. Q1 GDP growth forecasts a healthy 2%. And a stable dollar and recovering Europe and China should help overseas earnings. Bottom-up expectations for $50.7 of S&P 500 earnings is 6% lower than Q4. Forecasts also been cut 6% from January, double average. This sets the US up for another quarter of beating lowered expectations and a healthy ‘beat’ rate.

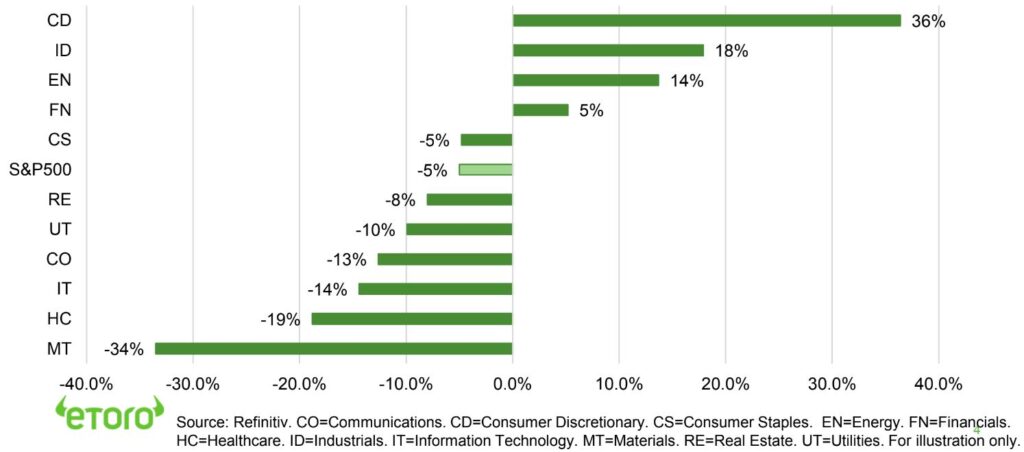

Disconnect with market performance as cyclicals lead and tech and defensives lag

Q1 earnings growth is set to be led by cyclicals, consumer discretionary (AMZN), industrials (Airlines), and energy. Whilst laggards are materials (DOW to MOS), healthcare (MRNA to PFE), and tech, with semis profits slumping 40%. This disconnect with market performance comes as Tech see’s valuation relief from lower bond yields and addresses bloated cost bases, whilst cyclicals face fears of a looming recession.

Banks kick off Q1 and are in the spotlight after spate of failures. But regional banks are small

Banks kick off Q1, doubly in the spotlight after recent bank failures. Expect to see positive earnings growth vs an easy comparison of weak capital markets activity last year. And the strongest growth in revenue of all sectors. Regionals are only a tenth of the overall sector, and big banks been relative ‘scare’ beneficiaries.

Europe to do better again, with stronger earnings growth and wider profit margins

Stoxx 600 earnings seen rising 5%, on 2% sales growth, with margins expanding yet again. This is a slowdown from Q4’s big upside surprise with earnings +18%. Financials and utilities are seen leading and mining and real estate slumping. Italy, Switzerland, UK outperforming, and Germany and France lagging.

S&P 500 Q1 2023 earnings growth forecasts by sector (%, YoY)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle and stubborn inflation boost uncertainty, recession risk, and hurt markets. We see this gradually fading in 2023, with global growth stressed but resilient, inflation pressure slowly easing, and valuations now more attractive. Focus on cheap and defensive assets for a gradual ‘U-shaped’ market recovery. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the market rout, and now at average levels, and are supported high company profitability and near peak bond yields. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by defensive growth. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and tech/small cap/crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices amd reopening China with high ‘buffers’ of rising fiscal spending (defence and refugees) and weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by lack of big tech sector and 30% cheaper valuations vs US. Banks better capitalised and regulated but loans/GDP much higher. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. Broader EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, if global growth resilient and bond yields risen. Japanese equities among worlds cheapest but threatened by tightening monetary policy and stronger Yen with rising inflation and new BoJ governor. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors – like discretionary (autos, apparel, restaurants), industrials, energy, materials, and small caps – have cheap valuations, many with depressed earnings, and have been out-of-favour for many years. But they are significantly exposed to rising recession risks. Some especially cheap (energy) or see growth recovery (airlines). |

| Financials | Current stresses likely individual not systemic. Post GFC reforms boosted capital and size/speed of authorities response. But outlook for 1) less GDP growth, 2) lower bond yields and interest rates, and 3) valuation sensitivity after recent surprises, worsens outlook. Insurance and Diversifieds (like Berkshire Hatheway) more defensive. |

| Themes | Dividends and buyback themes attractive with resilient cash flows, rising pay-outs, and investor search for defensives. Power of compounding dividends under-estimated, at up to 1/2 of total long term return. Small caps pressured by rising recession risk. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has wide spread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attrative cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+ supply and Russia 10% world oil supply problems. But commodities not to repeat their 2022 performance leadership. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.