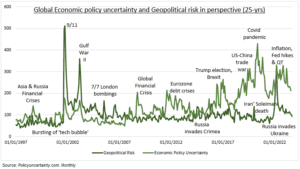

UNCERTAINTY: Hamas’s terrorist attack on Israel and the risk of escalation has stoked economic and geopolitical uncertainty. This risks sapping both investor and company confidence at a vulnerable time. With the economic, interest rate, and earnings cycles all in the process of turning. Geopolitical fears had eased from the spike around Russia’s invasion of Ukraine (see chart). But been replaced by higher, more entrenched, and more global, economic uncertainties. Yet stock markets had become used to this ‘new normal’ of high uncertainty. Whilst the history of geopolitical shocks is they usually, but not always, have limited and short-lived market impact.

IMPACTS: High and rising uncertainty is costly. It saps economic growth and corporate capex, delays decision making, and cuts back capital flows. But the history of tragic geopolitical shocks of the past 70 years is of relatively limited stock market impacts. With an average 6% S&P 500 drawdown lasting four weeks. But with big outliers, from Pearl Harbor to the first gulf war and 9/11, which saw double-digit losses over longer period. The economic policy uncertainty index is created from ‘uncertainty’ mentions in leading news media of 21 countries. The geopolitical risk index was created by the US Fed from ‘geopolitical’ mentions in 10 leading global news media.

COUNTRIES: China has the highest absolute uncertainty index level, and is 52% above its long-term average, as it deals with its struggling reopening recovery, low consumer confidence, and global manufacturing weakness. Germany is a surprising second, and 280% above its average, with its economy in recession for the last two quarters. The UK is 31% above average, as it deals with its economic stagflation. The US is a clear outlier, with uncertainty 40% below average with the economy still growing robustly and the Fed likely stopped hiking interest rates.

All data, figures & charts are valid as of 17/10/2023.