CRYPTO: Bitcoin has hit new lows for this ‘crypto winter’. The FTX bankruptcy is just latest in this year’s string of self-inflicted damage. Uncertainty is high and may continue. With immediate concerns, from Genesis to Grayscale, and medium term, over less institutional adoption and VC funding. But the surprise has been a lack of broader impact. Crypto prices have eased not collapsed. Correlations with other assets plunged. More broadly, retail ownership, institutional investor adoption, and measures of blockchain utility had been resilient to this year’s big sell-off.

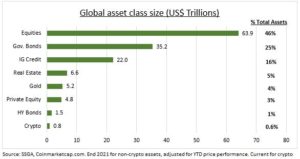

WHY: This limited contagion can be part explained by 1) the long crypto ‘winter’ so far, with the sell-off deeper and starting earlier than other asset classes. Any investment ‘tourists’ are long gone. 2) The asset class is now very small, at under $800 billion of market cap (see chart), a 70th the size of equities, and with limited direct connections. 3) The correlation between equities – particularly tech – and crypto assets has collapsed to the lowest of the year. Related equities have outperformed crypto. See @BitcoinWorldWide value chain versus @CryptoEqual coins.

OUTLOOK: Crypto assets may gradually put this string of self-inflicted crises behind it. Macro headwinds are set to ease as we near the top of the Fed interest rates cycle. The FTX bankruptcy may drive accelerated regulatory guard rails and underpin a return of institutional interest. The latest Gartner hype cycle reminds us not to equate market prices with the utility of the technology. Much of the ecosystem is in its attractive ‘disillusionment’ and ‘enlightenment’ segments. Bitcoin active addresses have been stable, even as transaction volumes slumped. Ethereum’ merge happened, broad CBDC tests underway, and next bitcoin halving on horizon.

All data, figures & charts are valid as of 24/11/2022