SQUEEZE: Initial public offerings (IPO) are making a tentative comeback after two-years of depressed activity. The number of US IPOs is up 10% this year even as the Renaissance IPO index still struggles. IPOs are a mixed blessing. Giving new investment opportunities. From the recent Reddit (RDDT), Ibotta (IBTA) and Amer Sports (AS) IPO’s and GE (GE) spin-offs. To upcoming listings from Viking cruises, Puig luxury, and CVC private equity. But it also starts to undermine the stock supply deficit that has helped support markets. The trend is increasingly for more global IPO issues, with smaller free floats, more dual class structures, and less profits.

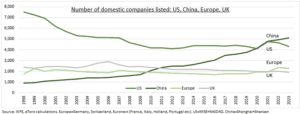

DE-EQUITISATION: The number of listed stocks has been shrinking for years, even as average market capitalisations have been rising. With the number of IPO’s and spin-offs unable to keep up with delisting’s and share buybacks. With mergers and acquisitions (M&A) activity leading to delisting’s. And US companies as the biggest buyers of stocks, purchasing $800 billion to $1 trillion of shares a year and shrinking free floats. In the past 25-years the total number of US stocks has fallen by 40% and in the UK by 20% (see chart). Whilst local China listings have surged fivefold and contributed to the huge gap between its booming economy and languishing stock market.

IPO’S: Much about the typical IPO remains the same. The average IPO company is nine years old, half are venture or private equity backed, and a third from the tech sector. But we have also seen four big changes in the US. 1) The proportion of IPO’s listing with a dual share class has tripled to 30% versus a forty year average of 10%. 2) The proportion of US IPOs by foreign companies has soared. To over 40% of total last year, with half from China, vs an average 12%. 3) Publicly available share floats have halved, to 15% last year vs an average 29%. 4) Whilst 65% of IPOs in the past decade have had negative earnings versus a long run average of 42%.

All data, figures & charts are valid as of 22/04/2024.