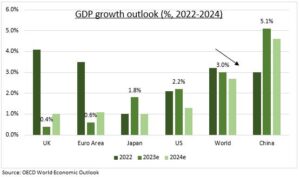

OUTLOOK: The latest economic update from the richer-countries OECD club makes the case for stronger growth today, but some coming payback tomorrow. World GDP growth is at a better-than-feared 3.0% this year but next year’s outlook cut to 2.7% with US and Japan leading the slowdown and Germany the contrarian rebound. This is the global ‘soft landing’ base case. But with still high risks, from sticky inflation to commodity shocks, that keep many on edge. This supports our positive view on markets but focused on long-duration assets, from tech to bonds, defensive to falling economic growth momentum and levered to lower inflation pressures.

GROWTH: World GDP is forecast to weaken from 3.0% to 2.7% next year. With inflation falling from 6.0% to a still-too-high 4.8%. GDP forecasts have been revised up for the US, Japan, and more surprisingly the UK. Whilst cut for Europe and China. But looking into next year the biggest slowdowns are in US and Japan, and Germany the biggest rebound. Resilient growth and sticky inflation are a recipe for higher-for-longer interest rates and only a slow easing in monetary policy as higher borrowing costs gradually have their impact. With services leading the current slowdown, whilst manufacturing searches for a bottom at already depressed levels.

RISKS: The wall-of-worry remains high and list of risks long. From food and energy disruptions that we are living now, from OPEC to El Nino supply disruptions. To global contagion from any continuance of China’s weaker-than-hoped economic reopening as we roll into 2024. To the undermining of longer-term growth by rising trade protectionism, the constraints of higher debt levels, and mounting demographic drags from healthcare and pension costs. The world needs a step-up structural reform, to boost productivity, and climate investment, to reach net zero goals.

All data, figures & charts are valid as of 19/09/2023.