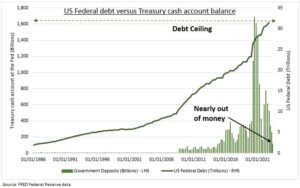

COMPLACENT: The US government’s ‘checking account’ is approaching critical levels (see chart). A deal to raise the $31.4 trillion debt ceiling is needed soon. It will ultimately be done, but not without four costs to the US economy and markets. Short term 1) unnerving of bedrock debt markets, and 2) a possible payment prioritization hitting consumer spending. Longer term 3) spending cuts become a meaningful GDP drag, and 4) catch-up bond issuance tightens liquidity. This is all negative and self-inflicted. Stock investors are complacent about this and we see risk of higher volatility. But ultimately we see the positive drivers of lower inflation and speedier interest rate cuts boosting the long-duration heavy stock market versus real economy cyclicals.

SHORT TERM: 1) One month Treasury bill yields have surged to a record 5.7%. Whilst one year credit default swaps (CDS) are up 10x since the beginning of the year. This is all spreading uncertainty and tightening conditions in the bedrock of the world’s biggest bond markets. 2) If negotiations drag past the ‘X-date’ then it seems authorities will prioritize debt repayments over government salaries and social security payments. This will be a consumption growth drag.

LONGER TERM: 3) A deal will see spending cuts, focused on discretionary outlays that are c23% the budget. Military spending is half of this, with the remaining led by health, education, and veterans’ benefits. The 2011 Budget Control Act that ended the previous debt standoff saw $900 billion of cuts over a decade, making the government a GDP drag for the next four years. Something equivalent now could cut c.0.50% from next year’s consensus of only 0.8% GDP growth. 4) Furthermore an increased debt ceiling could trigger up to $1 trillion of bond issuance by the September end of the government’s financial year. This would suck up liquidity and crowd out other investments, reversing the trends that have helped support markets in recent months.

All data, figures & charts are valid as of 24/05/2023