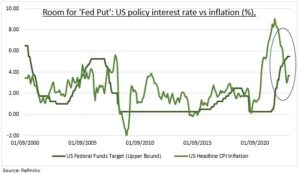

FLEXIBILITY: The ability of central banks to respond to any sharp economic slowdown, and stock market weakness, by cutting interest rates is rising. The so-called ‘Fed put’, coined from the 1987 Black Monday crash onward, is set for a gradual and important comeback. This is a valuable market insurance policy, removing the most bearish scenario for investors. Of a hawkish Fed hiking regardless of the economy. It’s a big change from six months ago. Interest rates are now high and restrictive. Inflation fallen significantly with expectations well-anchored. And central banks increasingly on a ‘hawkish pause’ (see chart). Flexibility is greater for those with dual inflation and growth mandates like Fed, notwithstanding Powell’’s recent protestations.

WORST CASE: The worst case for stock markets was for higher-for-longer inflation forcing the Fed to prioritize its fight with ever higher interest rates, regardless of a weakening economy. This was a plausible scenario just a few months ago, but is less likely today. Inflation was higher then (6%+), breakeven expectations higher (2.7%), and interest rate hikes just slowed from their aggressive 50-75 bps per meeting pace. Then the talk was not of a Fed ‘put’ but of its exact opposite, a ‘call’. As it focused on inflation, its credibility, and on not repeating the mistakes of the 1970’s. With both valuations and earnings high this was a recipe for stock market pain.

THE ‘PUT’: Talk of a Fed ‘put’, of cutting interest rates or providing other support to markets, started during Chair Greenspan’s 1987-2006 term. With Fed support after the October 19, 1987, Black Monday stock market crash. When the S&P 500 index fell over 20% in a day and the VIX hit 150. And it gained momentum from their, through the 1998 LTCM bailout, the GFC, 2010’s decade of QE, to the Fed support through the 2020 covid crash and March 2023 bank scare.

All data, figures & charts are valid as of 25/09/2023.