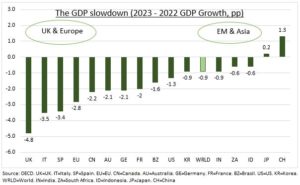

OUTLOOK: We are positive about the 2023 market outlook, but recognise risks are high. We see lower inflation and an end to rate hikes giving some needed valuation relief. Just as weaker GDP growth eats into earnings more dramatically. Latest GDP forecasts (see chart) highlight the Asia and emerging markets opportunity next year, especially if the dollar has peaked. But also the slowdown risks in attractively valued Europe that threaten its current fiscal and FX buffers. Energy prices are the huge wild-card, both for the inflation and the ever key consumer outlook.

NOW: November flash PMI’s clearly show the tightening global race between recession risks and cooling inflation. PMI’s are well into contractionary territory below 50, with both new orders and employment falling. PMI’s stabilised versus prior months in the EU (47.8), UK (48.3), and Australia (47.7). Whilst the US (46.3) caught up with the depressed numbers in these regions. The silver-lining came from falls in price pressures. They are now at some of the lowest levels since 2020 as supply chains ease and demand risks mount. This supports lower inflation ahead.

2023: The OECD was just the latest to cut the GDP outlook for next year. It sees global growth slowing from 3.1% to 2.2%. Recessions are forecast in the UK and Germany. Whilst Japan and China are the only two seen with stronger growth. Asia remains the growth bulwark if the rest of the world is to narrowly skirt a recession. The focus is on the ability of lower inflation to cushion consumer spending. They also highlights the scale of the energy crisis, just as European natgas prices start to rise again. 18% of global GDP is now being spent on energy, up from under 10% two years ago. This is a huge wealth transfer away from consumers and towards producers.

All data, figures & charts are valid as of 23/11/2022