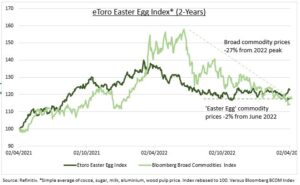

EASTER: Our ‘Easter egg’ index of commodity prices used to make (cocoa, sugar, milk) and package (aluminum, wood pulp) Easter eggs has risen this year. It has been led by double-digit surges for cocoa and sugar. And comes even as broad commodities have been the weakest of all asset classes. This will keep the pressure on consumer Easter egg prices and is indicative of continued food supply chain pressures. This is not welcome. With consumer food inflation rising at 9.5% in the US and 18% in the UK, well ahead of headline inflation. This is driven by supply disruption rather than stronger demand and is especially difficult for policymakers to manage.

SUGAR: It’s the best performing big commodity this year (+16%) and main food and beverage sweetener. It’s a large (200 million ton) but low value ($460/t) market. Prices are at a six year high. India, the world’s second largest producer, has seen drought-driven production shortfalls and export quota cuts. Europe’s sugar beet production has been hurt by high energy prices. Whilst high oil prices and local tax changes are incentivizing substitute biofuel demand in Brazil, the world’s no.1 producer. Reopening demand is boosting consumption from US and Asia. See sugar and sweetener stocks like Suedzucker (SZU.DE), Tate & Lyle (TATE.L), Ingredion (INGR).

COCOA: By contrast its a small (5 million ton) but high value (US$2,900/ton) market dominated by Ivory Coast and Ghana supply (60% of total) and chocolate and cosmetics demand. Hopes are high for a good harvest, to ease supply concerns that have boosted prices 10% YTD. But port deliveries have so-far been weak. Demand is seen up only 1%, led by the US and Asia, amidst hope lower inflation boosts consumer buying power. Higher prices could ultimately hurt the profits of big users like Barry Callebaut (BARN.ZU), Hershey (HSY) and Nestle (NESN.ZU).

All data, figures & charts are valid as of 04/04/2023