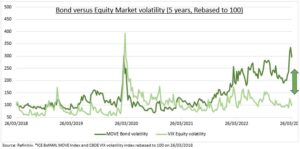

BONDS: The real market action in recent months has been in asset classes outside of equities. With bitcoin surging and commodities plunging. Bonds have been no exception. Rallying after a historically bad 2022. But with a new dramatic surge in volatility (see chart). This took the MOVE index to levels above the covid crisis and seen only rarely in the global financial crisis. Implied bond volatility is now higher than for equities. This reflects the current extreme macro confusion. With inflation sticky. Economic growth surprisingly resilient. The Fed ‘data dependent’. And the impact and extent of the banking sector ‘scare’ unknowable. These high MOVE levels should gradually ease, but do have real world impacts. Speeding the economic and inflation slowdown.

IMPACT: Bond volatility seems esoteric but it is important for 3 reasons. 1) Highlighting the huge uncertainty on the macro-economic and interest rate outlook. A reminder for diversification and humbleness. 2) It stands in stark contrast to the long term average VIX equity volatility. One of these huge asset classes is wrong. 3) And it has big consequences. This high volatility will filter into the real economy, as lenders price up loans to account for this uncertainty. This will only add to the underlying tightening in both financial conditions and lending standards that we see continuing. This will speed the growth slowdown, but also inflation and ultimately interest rates.

MOVE: The Merrill Lynch Option Volatility Expectations (MOVE) index is for US Treasury bonds what the VIX is for the S&P 500. It’s the ‘fear gauge’ for the bond market. It measures implied Treasury rate volatility through options pricing. It is yield curve weighted from one month to thirty years. Whilst the VIX may now be underestimating the true level of equity volatility. As equity vol trading activity has shifted to the shorter-dated options that are not well represented in the VIX.

All data, figures & charts are valid as of 28/03/2023