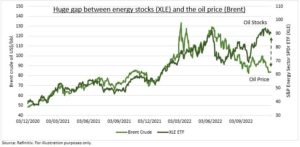

GAP: A yawning chasm has opened up between the 40% fall in oil prices from recent highs versus flat oil stocks (see chart). Something is going to give. We think the risk is oil prices move up to support stocks. With a ‘high-for-longer’ Brent crude price driven by chronically tight supply and still-resilient demand as China starts reopening. This risks dampening the lower inflation outlook that’s been helping markets. Whilst oil stocks are still helped by low production costs, rising estimates, and the US’ lowest valuations. We see physical oil and equities supported but not repeating their strong performance in 2023. New sector leadership is due. @OilWorldWide.

OIL: Prices slumped and backwardation is easing. But December 5th saw the double-barrelled introduction of G7 economies $60/bbl. price cap on Russian oil and EU’s ban on seaborne imports. This will disrupt an already tight market in the short term, even if in medium term it only redistributes flows to Asia. This comes on top of OPEC+ big production cuts, the tapering of US strategic reserve sales, and flattening of global drill rig recovery. A gradual China reopening balances rising recession demand risks elsewhere. It’s world’s no.1 oil buyer, at 16% of total.

STOCKS: US energy soared 60% this year, with one of greatest ever gaps vs the worst sector. This will not be repeated. But energy stocks are supported by oil prices four times production cost. It’s also one of only two sectors seeing earnings estimates rising for Q4 and 2023, as analysts boost cautious forecasts. US oil side-stepped Europe’s windfall taxes. It’s the cheapest sector at under 10x P/E next year. This is a 45% discount to S&P 500 average, and with strong dividends and buybacks. But it’s the 3rd ‘most crowded’ trade in the BofA monthly survey.

All data, figures & charts are valid as of 06/12/2022